Here's What Will Happen if Trump Gets His Way With Interest Rates

President Trump has consistently urged the Federal Reserve to lower interest rates, but doing so poses significant risks, including fueling asset bubbles and driving inflation to dangerous levels.

President Donald Trump has a longstanding history of pressuring the Federal Reserve to lower interest rates, a push that dates back to his first term in office—where he even advocated for negative interest rates. On Thursday, he reignited this campaign, declaring, “I’ll demand that interest rates drop immediately…” Trump’s rationale is straightforward: low interest rates stimulate economic growth and boost both the stock and housing markets. However, history reveals that economic booms fueled by excessively low interest rates are typically dangerous bubbles that eventually burst, rather than sustainable and organic periods of growth. Additionally, persistently low rates exacerbate inflation. Let’s delve into some charts and data to explore why Trump’s call for rate cuts is fundamentally flawed.

A closer look at the Federal Reserve's key interest rate, the Fed Funds Rate, reveals that it currently stands at 4.48%, which is still relatively low when compared to its historical levels over the past five decades. For context, rates once exceeded 19%. The Fed began its most recent rate hikes in 2022 to combat inflation, which had surged to nearly 10%—its highest level since the early 1980s. Given such high inflation, interest rates have arguably been too low and should have been raised even further to address the issue effectively. Nevertheless, this is the benchmark interest rate that Trump envisions dropping closer to 0%, or even into negative territory.

If Trump succeeds in pushing for lower interest rates, one likely outcome would be surging inflation—a paradox given that a significant portion of his 2024 presidential campaign centered on reducing inflation, a key rallying point for the “Let’s Go Brandon” movement, which emerged in response to soaring gasoline prices during the post-pandemic economic reopening. The reality is that inflation remains persistent and entrenched, even without a significant reduction in interest rates. At its latest reading of 2.4%, it still exceeds the Federal Reserve’s target of 2%, as measured by the Personal Consumption Expenditures (PCE) price index.

To make matters worse, future inflation expectations have been surging since September, further amplified by Trump’s recent victory. This trend is evident in the 5-year breakeven inflation rate chart shown below, along with real-time data from Truflation’s U.S. Inflation Index, the University of Michigan's 1-year inflation expectations survey, and the performance of the ProShares Inflation Expectations ETF.

Aggressively cutting interest rates wouldn’t just reignite inflation—it would also turbocharge the stock market, which is already experiencing a dangerous bubble. Such a move would amplify the risks of a devastating collapse when the bubble inevitably bursts. Lowering rates during a bubble is akin to pouring gasoline on a small flame—an explosive reaction is inevitable. As the chart below illustrates, the tech-heavy Nasdaq 100 has skyrocketed nearly twentyfold since January 2009, driven in large part by aggressive Federal Reserve stimulus. This has left the index wildly inflated and highly vulnerable to a sharp bear market.

A clear indicator of the U.S. stock market's extreme overvaluation is the total U.S. stock market capitalization-to-GDP ratio, famously referred to as "Warren Buffett's favorite indicator." This metric, which measures the total value of the U.S. stock market relative to the economy's size, reveals that the market is currently more inflated and vulnerable than it was even during the late-1990s dot-com bubble, which ended in a disastrous collapse. If Trump succeeds in significantly lowering interest rates, this bubble would likely expand further, amplifying the risks of an even more severe market downturn when it eventually bursts.

Another clear sign of the speculative frenzy gripping the markets is the recent surge in virtually every cryptocurrency—from Bitcoin and XRP to meme coins like Dogecoin and Fartcoin. Most of these cryptocurrencies serve little to no real-world purpose beyond pure speculation, as I’ve detailed previously. If Trump gets his way and has interest rates significantly lowered, the bubble in speculative assets like cryptocurrencies would intensify, eventually leading to a catastrophic burst and significant losses for the majority of investors caught in the frenzy.

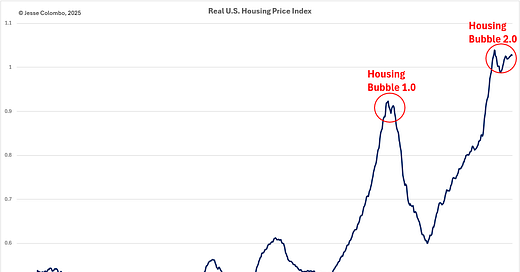

Beyond the bubble in speculative assets like stocks and cryptocurrencies, U.S. housing prices are hovering near all-time highs, both in nominal terms and inflation-adjusted (real) terms, as shown in the chart below. Real housing prices are a reliable indicator of potential bubbles, and current levels exceed even those seen in the mid-2000s housing bubble that ultimately collapsed, triggering the Great Recession and Global Financial Crisis. If Trump succeeds in pushing for significant interest rate cuts, this housing bubble would likely inflate further, becoming even more threatening. Additionally, such a move would make housing even less affordable for many Americans, whether they are looking to rent or buy.

Although President Donald Trump identifies as a conservative, his policies align more closely with populism. His fiscal and monetary positions diverge sharply from traditional libertarian or conservative principles, as demonstrated by his persistent push to supercharge the economy during his tenure through a mix of ultra-low interest rates and debt. As he famously stated in 2016, “I’m the king of debt. I’m great with debt. Nobody knows debt better than me.” This approach likely explains the recent strong rally in gold, and it’s why I anticipate Trump’s current presidency will once again be highly favorable for precious metals, much like his first term.

For the sake of our country, I genuinely want President Trump to succeed in improving it, and I believe he’s making positive strides in areas like securing the border and fostering a more business-friendly environment. However, as a Ron Paul-style libertarian (a perspective many gold bugs share), I can’t help but cringe at many of his economic plans—such as slashing interest rates to ultra-low levels or creating a digital asset stockpile centered on random cryptocurrencies while completely excluding gold and silver. It will be important to monitor whether Trump successfully pressures the Federal Reserve to lower rates or appoints a Fed chair who aligns with his vision. Either way, Trump’s presidency is no reason to abandon gold and silver—in fact, it’s a compelling reason to double down on them.