Positive Signs Are Emerging in Silver

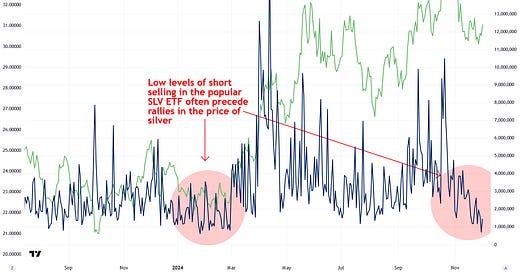

Investor sentiment toward silver is awful right now, which ironically is a reason for optimism. Moreover, several other positive signs are beginning to emerge.

It’s been a tough month for us silver bulls, as silver took a hit with Trump’s election win serving as a convenient excuse for a sell-off, as many fair-weather friend investors jumped ship in favor of cryptocurrencies and meme coins—many of which are utterly pointless and absurd. It’s baffling, but as they say, common sense isn’t all that common. Investor sentiment toward silver is abysmal right now, which, from a contrarian perspective, is actually a reason for optimism. Adding to that, several emerging positive factors are making me increasingly confident in silver’s near-term prospects.

Over the past couple weeks, silver has stabilized and formed a double-bottom pattern, marked by three hammer candlesticks—frequent indicators of market bottoms. This potential reversal is unfolding at a key technical juncture: the confluence of the uptrend line established in February and the downtrend line from May, further reinforcing the case for stabilization and a bottoming formation. For the bulls, the next critical step is to drive silver above the resistance level at $31.50. A successful breakout should pave the way for silver's bull market to resume, passing through $35, $40, and beyond.