Trump's Tariff Threat Fuels Ongoing Gold & Silver Market Volatility

There's a frantic global scramble for bullion as major dealers rush to move gold into the U.S. ahead of potential tariffs.

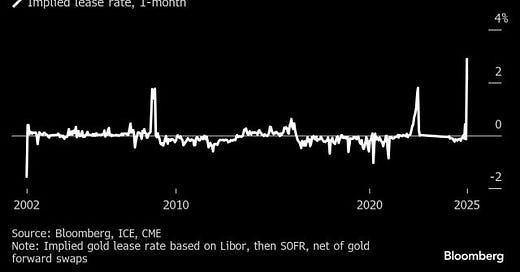

Around a month ago, I wrote about how the gold and silver markets were being roiled by the possibility that imported gold and silver could be subject to tariffs announced by the newly elected Trump Administration. This uncertainty prompted banks and hedge funds to scramble to cover short positions. Since then, ongoing speculation about these potential tariffs has fueled continued volatility in the gold and silver markets, particularly as the January 20th inauguration of President Trump approached. In addition, a frenzied global rush for gold and silver bullion has unfolded, with major dealers racing to move metal into the U.S. ahead of any potential tariff imposition.

The disruption in the precious metals market has been evident in the behavior of front-month futures contracts for silver (March) and gold (February) compared to their spot prices. Futures prices have been climbing sharply above spot prices, reflecting the urgency of banks and funds scrambling to mitigate risk by closing out short positions, driving gold and silver prices higher in the process. Typically, front-month futures and spot prices move in close alignment, but in recent weeks, they have frequently diverged in an anomalous manner.

For instance, in the days leading up to the inauguration, the premium for front-month silver futures surged from 56 cents per ounce to $1.12, far above the typical 14-cent range. On the morning of January 20th, the premium dropped sharply from 88 cents to just 52 cents after the Trump administration released a memo stating that broad tariffs would not be imposed on Day 1 of his presidency. Instead, the administration announced plans to first conduct reviews of trade and currency imbalances. However, the premium rebounded sharply later that day when President Trump suggested he might impose 25% tariffs on Mexico and Canada starting February 1.