Will DeepSeek Burst the AI Bubble?

DeepSeek, China's newly launched competitor to ChatGPT, made its weekend debut, triggering a sharp decline in U.S. technology stocks on Monday.

This weekend marked a "Sputnik Moment" for the U.S. artificial intelligence industry, as Chinese AI model maker DeepSeek burst onto the scene with a debut that quickly catapulted it to the top of iPhone app download charts in the U.S., surpassing OpenAI's ChatGPT. The development sent shockwaves through the U.S. tech sector and AI-related stocks, underscoring the emergence of serious foreign competition—made all the more unsettling by its origin in China. DeepSeek's claims of greater efficiency, achieved by leveraging cheaper chips and less data than the leading American AI systems, have further intensified concerns. Speculation is now mounting that DeepSeek could be the catalyst to burst the high-flying U.S. AI stock bubble.

DeepSeek has stunned the world with its exceptional performance. Venture capitalist Marc Andreessen called the model “one of the most amazing and impressive breakthroughs I’ve ever seen.” What’s even more remarkable is that it is open-source and reportedly cost less than $6 million to train—an astonishing contrast to OpenAI’s GPT model, which exceeded $100 million in training costs.

Furthermore, DeepSeek achieved this without relying on cutting-edge U.S. GPU semiconductors from companies like Nvidia, which are banned from export to China due to national security concerns. This raises serious questions about whether the massive spending on AI by U.S. tech companies in recent years has been justified, a realization that contributed to a sharp selloff in high-flying AI-related stocks on Monday with Nvidia plunging 16.97%, Broadcom tumbling 17.4%, Taiwan Semiconductor sinking 13.33%, Micron Technology dropping 11.71%, and AMD sliding 6.37%. The selloff dragged the tech-heavy Nasdaq 100 down by nearly 3%.

The AI boom has been a rare bright spot for the U.S. economy and stock market since late-2022. Morgan Stanley estimates that the four largest U.S. tech companies will collectively spend up to $300 billion this year alone on AI infrastructure. In terms of economic impact, AI-related investments are poised to surpass the GDP share driven by the late 1990s dot-com boom and could rival the contribution of housing during the 2000s bubble.

On January 21st, just one day after his inauguration, President Trump announced a $500 billion AI infrastructure initiative named Stargate. He stated that the project aims to solidify the United States' leadership in artificial intelligence while creating 100,000 new jobs. However, the unexpected emergence of the ultra-efficient DeepSeek at the same time casts doubt on the viability and competitiveness of such a massive investment.

While most U.S. stocks have plodded along in recent years, a select group of large tech companies—many deeply involved with AI—has thrived, creating an unprecedented concentration of market dominance in the benchmark S&P 500. Dubbed the "Magnificent 7," these dominant companies include Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla. The chart below illustrates the market capitalization of the largest U.S. stock relative to the 75th percentile stock, highlighting how top-heavy the U.S. stock market has become. However, when the stock market becomes excessively reliant on a narrow group of high-flying stocks, it often signals the existence of a bubble.

The meme below, satirizes the U.S. economy and stock market's increasing dependence on the tech boom/bubble—over the past few years:

The AI boom, primarily centered in the United States, has propelled the U.S. stock market to significantly outperform its international counterparts—a phenomenon reminiscent of the frothy Nifty 50 bubble of the 1960s and the dot-com bubble of the late 1990s. However, the emergence of DeepSeek and potential future competitors could pose a serious challenge to American tech dominance, narrowing the U.S. stock market’s dramatic lead over global peers.

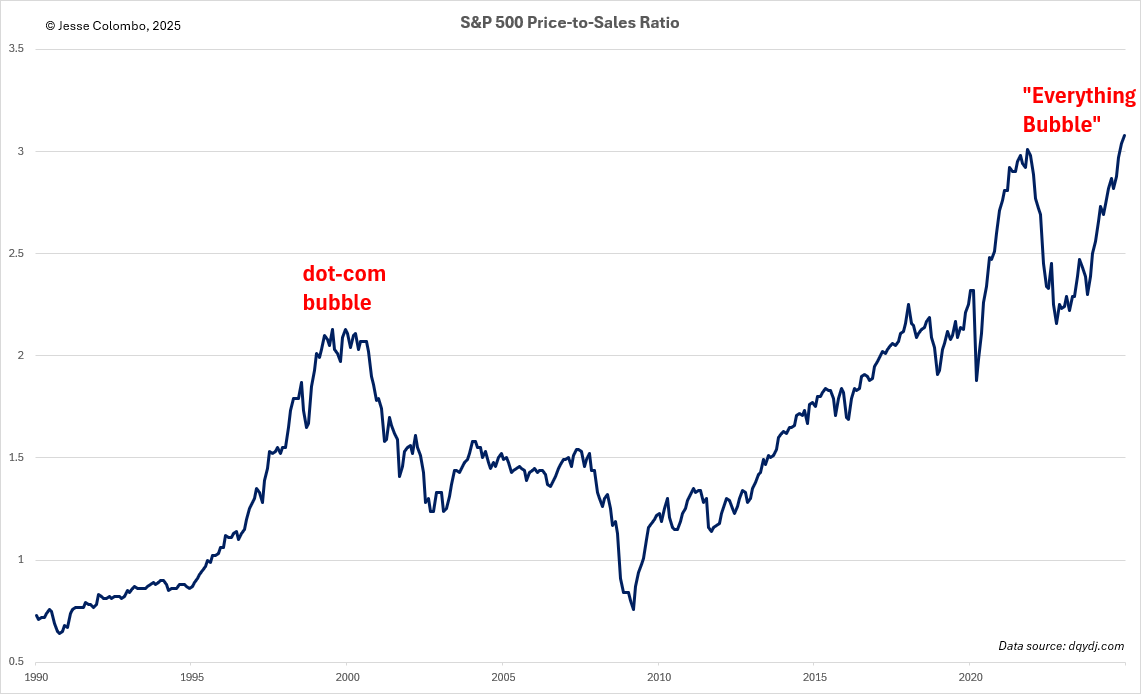

While the underlying AI technology is legitimate and here to stay, a good portion of the AI boom is actually a dangerous bubble. This mirrors the dot-com bubble, where the underlying technology of the internet was revolutionary and had a promising future, yet capital expenditures and stock valuations raced far ahead of reality, culminating in a dramatic crash. I see history repeating itself. Evidence of this inflated bubble is apparent in numerous valuation metrics, highlighting just how overheated the market has become.

To begin with, the S&P 500's price-to-sales ratio is now nearly 50% higher than its peak during the dot-com bubble, confirming the extreme level of overvaluation:

The Nasdaq 100, adjusted for the U.S. M2 money supply, reveals that tech stocks have outpaced the growth of the money supply—a pattern reminiscent of the dot-com bubble:

The ratio of the Nasdaq 100 to the S&P GSCI Commodity Index highlights how tech stocks have dramatically outperformed commodities, mirroring the trend seen during the dot-com bubble—only this time, the disparity is even more extreme:

Another clear indicator of the U.S. stock market's extreme overvaluation is the total U.S. stock market capitalization-to-GDP ratio, famously referred to as "Warren Buffett's favorite indicator." This metric, which measures the total value of the U.S. stock market relative to the economy's size, reveals that the market is currently more inflated and vulnerable than it was even during the dot-com bubble:

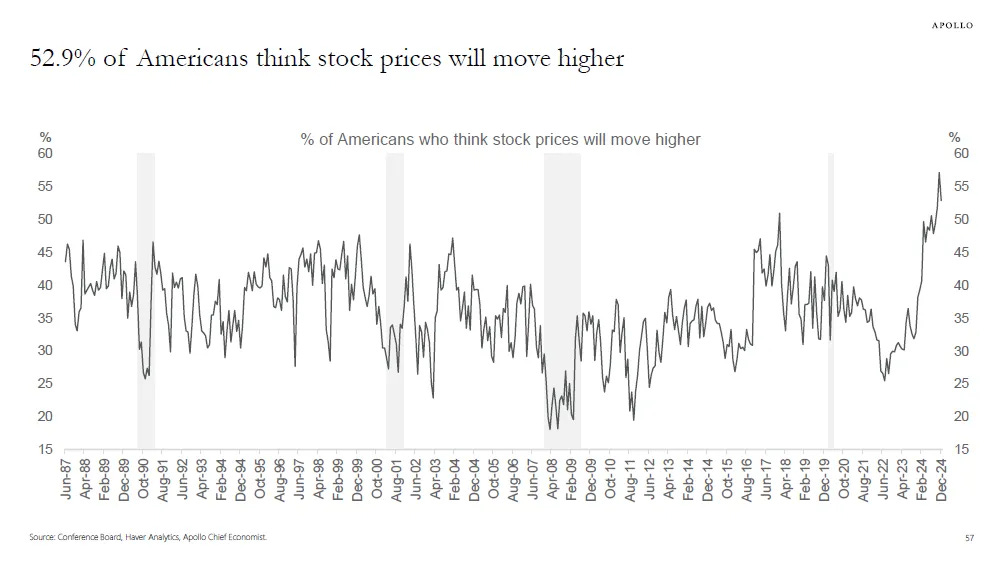

Alongside sky-high stock market valuations, Americans are exhibiting the highest level of stock market euphoria in at least four decades. According to the latest Conference Board survey, an astonishing 52.9% of Americans—surpassing the optimism seen during the dot-com bubble—expect stock prices to rise over the next twelve months. Unfortunately, such extreme optimism is a classic hallmark of a bubble, leaving the market vulnerable to a sharp downturn at even the slightest disappointment. The emergence of DeepSeek, potentially disrupting the U.S. AI boom, has strong potential to be the trigger that sends the market tumbling.

To determine whether the current AI stock selloff could deepen into a more significant downturn, let’s analyze the technical positions of these stocks, starting with the sector's leader, NVIDIA Corporation. Today’s nearly 17% plunge sent NVIDIA sharply below its uptrend line, which had been intact since the beginning of 2024—a troubling signal. Moreover, NVIDIA closed below its critical $125–$130 support zone, which had held the stock up in recent months. This breakdown has inflicted considerable technical damage on NVIDIA’s chart. With no clear support levels nearby, the near-term risk is skewed to the downside unless the stock can rally sharply and negate today’s breakdown.

The Philadelphia Semiconductor Index, which includes major players like NVIDIA that produce the semiconductor chips fueling the AI boom, has fallen below its uptrend line established in November 2023—a worrisome development. The next key support zone to monitor is between 4,300 and 4,800. If this support fails to hold, it would strongly signal the onset of an AI bust.

The Magnificent 7 exchange-traded fund (symbol: MAGS) isn’t showing as much weakness as NVIDIA, but a decisive close below the critical $50 support level would indicate that further declines in tech stocks are likely ahead:

The Nasdaq 100 index is hovering just above the 20,750 to 21,000 support zone. A bounce off this level would be an encouraging signal, but a decisive close below it on strong volume would likely indicate further downside ahead:

The bellwether S&P 500 index, while not exclusively composed of tech stocks, remains heavily influenced by them and may have formed a bearish double-top pattern over the past month. Confirmation of this pattern would require the index to close decisively below the critical 5,800–6,000 support zone. Should that breakdown occur, it would signal a broader stock market downturn, likely led by the tech sector.

Bitcoin is a key indicator for gauging investor appetite for risk assets, including stocks. As I recently explained, Bitcoin is highly correlated with the tech-heavy Nasdaq 100 index, often mirroring its movements. While Bitcoin surged following the election, it has since struggled to maintain momentum, disappointing investors who anticipated an even stronger rally. Similar to the S&P 500, Bitcoin may have formed a bearish double-top pattern over the past month. Confirmation of this pattern would require the cryptocurrency to close below the critical 90,000 to 92,500 support zone. A decisive close below this level would be bearish for Bitcoin and could also signal further weakness in the stock market.

While U.S. stocks—especially tech stocks—have delivered exceptional performance over the past decade, their extreme overvaluation means that much of the upside has already been realized. This significantly increases the likelihood of a sharp decline rather than another surge from current levels. The silver lining for precious metals investors is that such a downturn will create a highly favorable environment for gold, silver, and mining stocks.

Stocks and precious metals compete for capital, and when the stock market sinks into a bear market, it typically triggers a capital rotation. This shift is likely to result in massive outflows from overinflated equities into undervalued gold, propelling gold prices toward $10,000 an ounce and eventually even higher. This surge in gold will also provide a tailwind for silver, driving its value higher alongside it.

As shown in the chart below, each time the Dow-to-gold ratio breaks a major trendline, it signals the start of a new secular trend. A break below an uptrend line signals that gold is poised to outperform stocks, while a break above a downtrend line indicates that stocks will outperform gold. Notably, the major secular bull markets in both gold and stocks over at least the past century have been preceded by such trendline breaks.

What’s particularly exciting is that the Dow-to-gold ratio broke below its uptrend line in the spring of 2024. This indicates that a capital rotation from stocks to gold is already underway, and this shift will accelerate when the current stock market bubble inevitably bursts.

Although I am not a computer scientist, technologist, or AI expert, I am keenly aware of the excessive froth in the tech sector and tech stocks. With rampant optimism and sky-high valuations, even a minor disappointment or emerging threat could trigger a sharp decline in tech stocks and the broader U.S. market. The unexpected arrival of DeepSeek highlights the beginning of what is likely to be growing competition for U.S. AI companies in the years ahead. This is one of the many reasons I’m content avoiding exposure to U.S. tech stocks, instead finding comfort in the safety and stability of physical precious metals. I believe these will thrive when the unsustainable trust in everything virtual and "paper" eventually unravels.

If you enjoyed this free report, please consider upgrading to a paid subscription so that you can access all content.

A paid subscription to The Bubble Bubble Report costs a mere $15 a month—only 50 cents a day, which is less than a cup of coffee!

It offers exceptional value, keeping you informed and prepared to navigate these increasingly challenging times—times that are also brimming with opportunities for those equipped with the right knowledge.

Plus, if you choose an annual subscription, you'll save 11%, bringing the cost down to just $13.33 per month. →

One of the biggest downturns was in the uranium related companies. AI all of a sudden doesn’t need all that extra power.

Camaco was down 18%. Others down a lot also. Somebody forgot we still need more energy with or without AI.

A great and realistic article, agree 100%!

A question: Due to the huge investment in AI announced by Mr.Trump a product like DeepSeek could be ban in USA?