Don't Worry About Index Rebalancing

Despite all the fear surrounding the rebalancing of the Bloomberg Commodities Index, it is already largely priced in and will join the long list of worries that never came to fruition.

For the past two years of this precious metals bull market, which I expected and was bullish on from the beginning, there has been a constant stream of worries, rumors, and theories about what might cause it to end and crash back down.

It’s always something: the Russia-Ukraine war will end, the CME is going to raise margins, Trump might win the election and solve our most pressing problems, the stock market could collapse, there is a double-top in silver, gold will be mined from asteroids, or Mozambique may declare war on Madagascar (I’m kidding about the last two, of course).

Yet despite those worries, and the new ones that keep popping up and will continue to pop up, gold and silver continue to march ever higher in utter defiance of those worries. The simple reason for that is that precious metals are in a powerful secular bull market that I expect to last at least a decade based on history, and there is nothing that can derail this train until its time is up.

This pattern that I described always occurs in bull markets, including in the stock market, and bull markets are said to "climb a wall of worry," which is clearly the case with the current precious metals bull market.

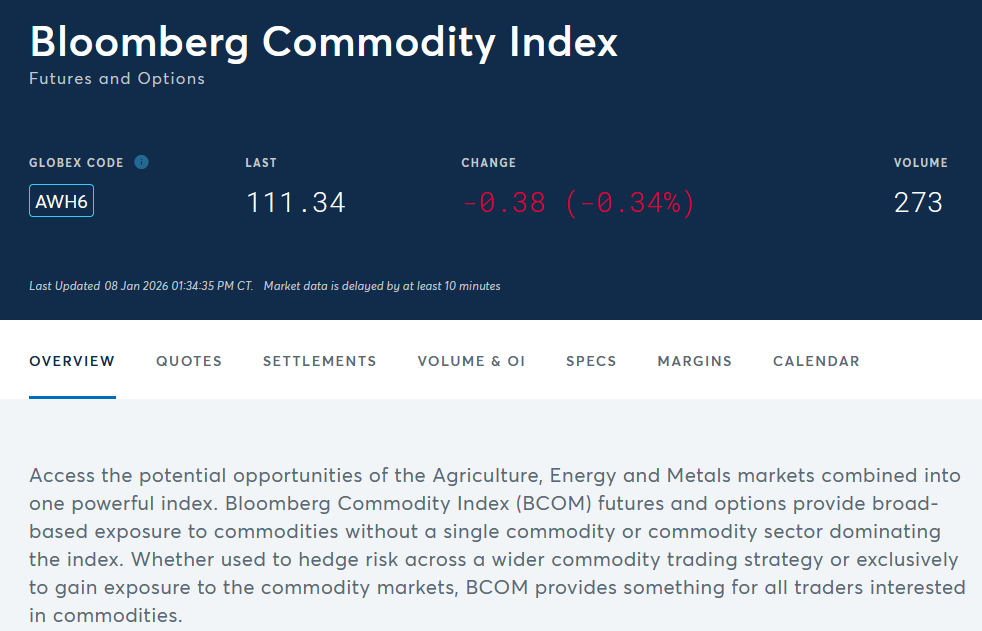

There is now a new worry du jour in the precious metals market, and my inbox has been flooded all at once with panicked messages about the same issue. (In my experience, that is often an excellent contrarian signal to fade the fear.) This concern centers on an upcoming routine annual rebalancing (learn more) of the Bloomberg Commodities Index, scheduled to take place from January 9th to 15th, which many retail investors are now fearing will be the straw that finally breaks the back of gold and silver’s bull market.

Let me explain what this rebalancing is and how it works in simple terms. The Bloomberg Commodities Index is a broad index of commodities, including precious metals, and can be thought of as similar to the Dow or S&P 500 for commodities. Because of this, there are a number of exchange-traded funds (ETFs) and other financial products that are based on the Bloomberg Commodities Index. Buying activity in those products creates demand for the underlying commodities in the index, and vice versa, which in turn affects the prices of those commodities.