Frequently Asked Questions (FAQs)

Click the links below to read frequently asked questions and answers about The Bubble Bubble Report precious metals newsletter:

• What is The Bubble Bubble Report?

The Bubble Bubble Report is a best-selling newsletter published on Substack, a popular and rapidly growing online platform that allows writers and creators to publish newsletters and build subscription-based communities.

The Bubble Bubble Report is written by U.S.-based economic analyst Jesse Colombo and focuses on precious metals and major global economic risks, including credit and asset bubbles.

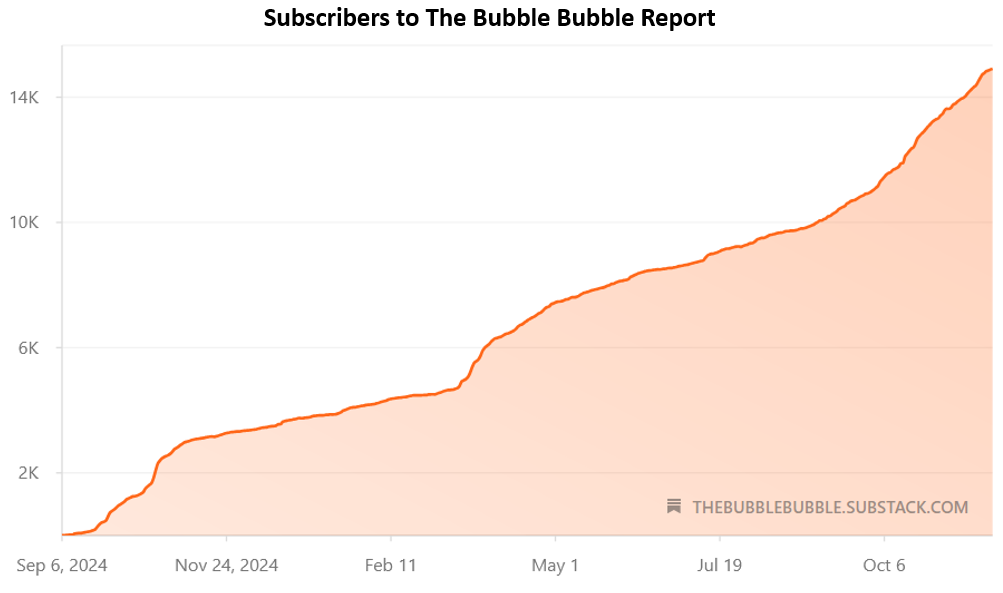

Although Colombo had already established himself in the industry with a large following, having gained recognition for predicting the 2008 Global Financial Crisis as a university student and writing an online column for Forbes for 11 years, he launched The Bubble Bubble Report in October 2024 to cover the burgeoning bull market in precious metals he had been anticipating.

Within its first year, the newsletter quickly became one of the world’s most popular in the precious metals space, gaining over 10,000 subscribers (now over 14,500) and achieving best-seller status with annual revenue of several hundred thousand dollars.

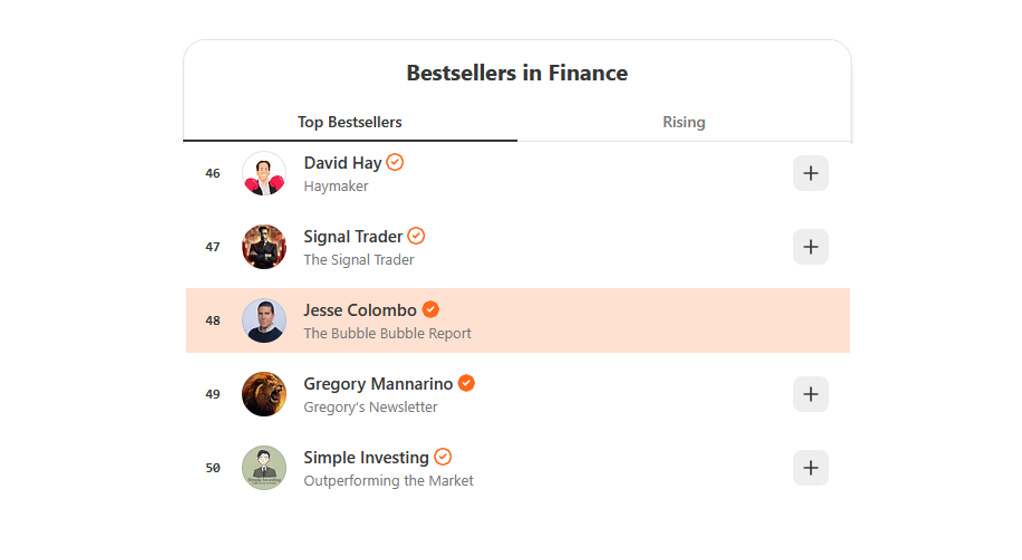

In November 2025, The Bubble Bubble Report broke into Substack’s Top 50 best-sellers in the finance category, ranking at #48:

The Bubble Bubble Report’s detailed, visually rich economic reports on precious metals and global economic risks (see some examples here) have gained a cult following in the worlds of finance and natural resource investing, with at least five billionaires among its active subscribers.

To learn more about our philosophy and worldview, the type of content we produce, the topics we cover, and the background of our author, Jesse Colombo, please continue reading the sections below.

• What’s the philosophy and angle behind this newsletter?

This newsletter specializes in gold and silver investing while uncovering and exposing major financial and economic risks, including dangerous bubbles in debt and asset prices that will trigger a devastating crash in markets and a global depression in the not-too-distant future.

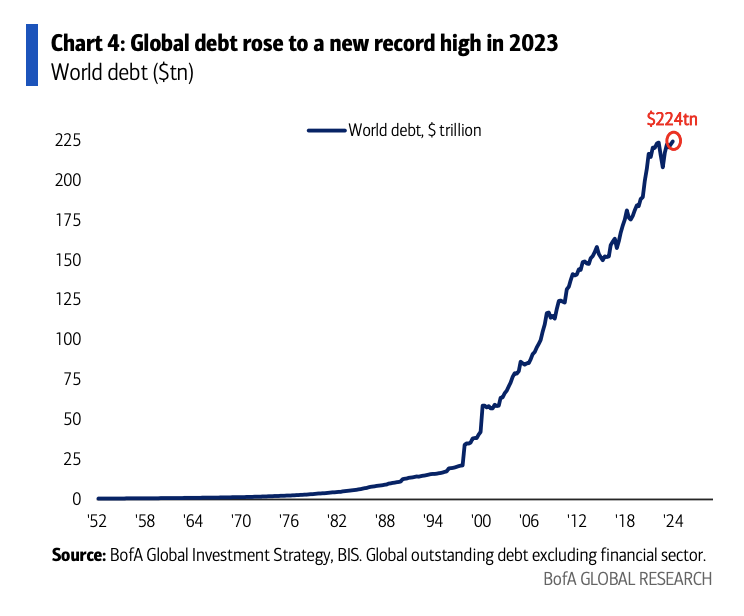

For example, total outstanding global debt has exploded 10-fold since the late 1990s, reaching $224 trillion, and it’s a massive bubble that’s destined to burst and bring the global economy to its knees:

Another major bubble is in the U.S. stock market, with numerous indicators revealing how outrageously overvalued it is. This includes billionaire investor Warren Buffett’s “favorite indicator,” the total U.S. stock market capitalization-to-GDP ratio, which shows that stocks are even more expensive now than they were during the late 1990s dot-com bubble that ended in a devastating crash. Unfortunately, this time will be no different:

As if those two bubbles aren’t alarming enough, wait because there’s more!

Another major bubble has formed in U.S. housing, with inflation-adjusted home prices now exceeding the peak of the mid-2000s housing bubble that triggered the 2008 crash.

Clearly, we didn’t learn from the last experience and are repeating the same mistakes, and once again this bubble will burst with devastating consequences in the coming economic downturn.

In addition to those three bubbles, Jesse also warns of numerous other dangerous bubbles forming around the world, including in the technology sector, startups and venture capital, private equity, U.S. wealth, corporate debt, auto loans, credit card debt, higher education, healthcare, and major property markets in Canada, Australia, Western Europe, and China.

The eventual bursting of these bubbles will result in a depression even more devastating than the Great Depression of the 1930s.

Jesse’s The Bubble Bubble Report newsletter actively tracks and analyzes all of these growing risks to keep subscribers informed and ahead of the curve.

While Jesse firmly believes that mainstream financial markets are headed for a major crash, he sees physical gold and silver bullion as the best way to protect and grow wealth during the coming turmoil, and he writes heavily from that perspective.

He is also highly bullish on the gold and silver mining sector due to its potential for significant upside and will be sharing more on that topic moving forward.

Jesse is also a survivalist and prepper (check out this TV interview), and he plans to create more content on that topic in the future, focusing on how to survive and thrive when the global economic bubble inevitably bursts.

• What assets and markets do you cover?

Our main focus is gold and silver, but we also frequently publish updates and analyses on the broader mining stock sector, as well as other metals like platinum, palladium, and copper.

We are also extremely bullish on commodities overall and expect another major commodities supercycle in the coming decade, similar to those of the 1970s and 2000s. As a result, we plan to cover additional commodities in the future, including other metals, energy, and agriculture.

We also cover other markets and economic issues that impact gold and silver, including the U.S. stock market, interest rates, the U.S. dollar, and even cryptocurrencies.

Finally, aside from our main focus on gold and silver investing, we publish reports about major economic risks around the world, including dangerous bubbles like those in the U.S. stock and housing markets, crypto, the global debt bubble, and the coming demise of fiat/paper money, as all of these are a big part of our extremely bullish thesis for gold, silver, and commodities, since capital will flow out of those bubbles and into hard assets, sending them to the stratosphere.

• Can I see some examples of your content?

Yes, here are some examples of reports we’ve published over the past year:

Gold’s Breakout Across Major Currencies Paves the Way for a Surge to $3,000

Here’s What the U.S. Presidential Election Means For Gold & Silver

Video Presentation: Here’s How Silver Price Suppression Works

Video Presentation: Silver’s Bull Market Has Officially Begun

We combine fundamental economic analysis with technical (chart-based) analysis to get the best of both worlds. We’ve found this approach to be highly effective and believe neither should be used in isolation.

• Who is the author of the newsletter?

Jesse Colombo is an economic analyst, private investor, and publisher of the bestselling newsletter The Bubble Bubble Report, which has over 14,500 subscribers.

Jesse is a popular financial media personality with over 250,000 social media followers and millions of views per month on all platforms (you can follow him on social media as well: X/Twitter, LinkedIn, and Facebook).

Jesse is frequently quoted in the media, and his research is widely published on leading sites such as Forbes, Fox Business, MarketWatch, The Jerusalem Post, ZeroHedge, Kitco, Money Metals Exchange, Gold-Eagle.com, 321Gold.com, BillHolter.com, SteveQuayle.com, DollarCollapse.com, GoldSeek.com, SilverSeek.com, King World News, GATA.org, MiningFeeds.com, GoldSeiten.de, TheBubbleBubble.com and many others.

Jesse describes himself as an “Austro-libertarian,” meaning he adheres to Austrian School economics, embraces a libertarian philosophy on politics and government, and strongly advocates for free markets and sound money.

Jesse wrote an online column for Forbes from 2013 to 2024.

In 2008, he was recognized by The Times (of London) for anonymously warning millions of people about the U.S. housing and credit bubble as a university student via a website he built called “stock-market-crash.net.”

In 2005, the LA Times recognized Jesse’s site as one of the four most highly-trafficked housing bubble-related websites.

Jesse earned a Bachelor of Science with cum laude honors from SUNY Stony Brook University in 2008.

• What is the author’s track record?

Jesse Colombo, the author of this newsletter, has a stellar track record in economic and financial market predictions, starting with his early warning to millions about the 2008 Global Financial Crisis while he was still in college, as described above.

Then, during his tenure as an online columnist for Forbes from 2013 to 2024, Colombo made numerous successful calls, including the 2014 crude oil crash, economic crises in Turkey, South Africa, and the Philippines, the February 2020 U.S. recession (which he foresaw two years in advance, down to the very month), and the bull market in Bitcoin starting in 2020, which led to a sevenfold surge from roughly $10,000 to $70,000.

In addition, Colombo has proven to be one of the most accurate precious metals forecasters in the world, as demonstrated by the following examples in recent years:

Predicting the start of gold’s $2,000-per-ounce bull market just hours before it began on March 1st, 2024 (see prediction here)

Predicting the start of the upcoming silver bull market in April 2024 (see prediction here)

Predicting gold’s surge from $2,500 to $3,000 during the summer of 2024 (see predictions here, here, and here).

Predicting gold’s rally to $3,500 in December 2024 (see prediction here)

Predicting the surge in precious metals miners in January 2025 (see prediction here)

Predicting a temporary cooldown in gold on the exact day it began, April 22nd, 2025 (see prediction here)

Predicting the tripling of Apollo Silver stock on June 26th, 2025 (see prediction here)

Predicting the surge in precious metals miners during the summer of 2025 (see predictions here and here)

Predicting the acceleration of silver’s bull market in July 2025 (see prediction here)

Predicting gold’s surge to exactly $4,400 on August 4th, 2025, a month and a half in advance (see predictions here and here).

Predicting the upcoming rallies in silver and copper on August 27th, 2025 (see prediction here)

Predicting a temporary cooldown in gold and silver on October 9th, 2025 (see prediction here)

Predicting the rebound in precious metals and mining stocks on November 5th, 2025 (see prediction here)

Predicting gold and silver’s post-Thanksgiving breakout on November 20th, 2025 (see prediction here)

Predicting platinum and palladium’s surge on December 10th, 2025 (see prediction here)

With such an impressive track record, it’s no surprise that within the first year of its October 2024 launch, The Bubble Bubble Report quickly achieved best-seller status, became one of the world’s most popular precious metals newsletters, and gained over 10,000 subscribers, and we’re only getting started.

• What does this newsletter cost?

A premium subscription is just $25 per month, or only $22.50 per month with the annual plan.

That comes out to just 83 cents a day, less than a cup of coffee, which is a small price to pay for cutting-edge financial insights from one of the most accurate precious metals analysts in the business.

(Note: All original subscribers who joined before October 1st, 2025 are grandfathered in at the original rate of $15 per month.)

• What is included in a paid membership?

We aim to publish two to three high-quality, visually rich reports, articles, or market analyses each week, and sometimes more depending on market activity.

We also publish free reports from time to time for the benefit of all subscribers, both paid and free.

Paid subscribers also gain full access to all archived content.

This newsletter combines fundamental economic analysis with technical and chart-based analysis to get the best of both worlds. We’ve found this blended approach to be highly effective and believe neither method should be used in isolation.

• How can I upgrade from a free to a paid subscription?

It’s very simple, just click the button below and follow the instructions:

• Why should I give your newsletter a try?

For just $25 a month, or only 83 cents a day, you can try this best-selling newsletter for a month and see if it’s right for you.

It’s a small price to pay for cutting-edge financial and economic research that’s avidly read by numerous leaders in the precious metals and natural resources sector, including at least five billionaires.

And in the worst-case scenario, if you decide it’s not for you, you’re free to cancel and you’ll only be out $25.

It’s a classic high-reward, low-risk proposition you’ll regret not taking advantage of. After all, the greatest risk is not taking one.

• How can I unsubscribe or cancel my subscription?

Whether you’re a free or paid subscriber to The Bubble Bubble Report, you can unsubscribe or cancel your subscription at any time, and it’s quick and easy to do:

If you’re a free subscriber, click here for easy instructions on how to unsubscribe

If you’re a paid subscriber looking to cancel your subscription, click here

• Do you have a money-back guarantee?

No, we do not offer a money-back guarantee. All sales are final. However, you can cancel your subscription at any time.

If you encounter any issues with your order, please contact us and we will do our best to help.

• Is this newsletter tax-deductible for businesses?

If you run a business or corporation and use this newsletter as part of your work, such as for research, analysis, investing, publishing, or financial decision-making, the cost of your subscription may be considered a deductible business expense.

Subscriptions to financial and professional publications are often tax-deductible when they are directly related to your trade or profession.

Please consult your accountant or tax advisor to determine how this applies in your country or specific situation.

• Do you publish daily news updates?

No, our focus is not on daily news-style updates about what happened in precious metals or the markets each day.

Our specialty is producing comprehensive, in-depth reports and analyses that feature compelling charts and data visualizations like the one below, all of which require significant time to research and create.

Click here to view samples of our reports to get a better sense of our style and caliber of content.

We aim to publish two to three times per week, depending on market activity.

There are plenty of news services that provide daily updates on precious metals, including Reuters, Bloomberg, and Kitco. We are not trying to compete with them.

Those outlets primarily focus on reporting news and events that have already occurred, rather than forecasting future trends as we do, and they mostly publish black-and-white, text-based content with few charts or data visualizations.

In contrast, our niche is producing deep, visually rich, and insightful reports with a clear focus on future events and trends that you won’t find anywhere else.

That said, whenever something important occurs in the precious metals market or the financial markets more broadly, we make sure to cover it.

• Do you provide trading recommendations or stock tips?

No, our focus is squarely on taking full advantage of the big secular bull market in precious metals, miners, and commodities that we believe is only in its infancy and that is going to take gold to at least $20,000 an ounce and silver to at least $500 an ounce.

We believe that the best approach is to invest in that with the long-term view in mind rather than trading in and out rapidly, which we believe will produce inferior returns with much more stress and risk compared to simply investing and letting this very lucrative thesis play out.

Though gold and silver may have a reputation as conservative, staid investments, we believe they will be anything but that in the years to come as the global fiat/paper money system rapidly approaches its demise, sending precious metals to the stratosphere and generating significant wealth for investors.

The value we provide, rather than frequent trading signals, lies in presenting the long-term bullish case for precious metals and commodities from numerous different angles.

We offer ongoing updates on how the bull market is unfolding, encouragement during periods of turbulence or pullbacks, and a wealth of educational material to help you become a more effective and confident investor.

Our subscribers consistently express strong appreciation for this approach in their feedback.

That said, our reports and analyses can be and are used very effectively by those who prefer to be more active traders, as you’ll see from the prescient examples here.

Just don’t expect us to provide a guided trading service or precise trading advice.

• Do you recommend specific mining stocks?

No. Although we are highly bullish on the precious metals mining sector as a whole and have provided many accurate analyses on it, including predicting the bull market at the beginning, our approach is a top-down macro one rather than bottom-up stock picking.

That means our analysis focuses on the sector as a whole, with an emphasis on mining stock exchange-traded funds (ETFs), rather than getting into the nitty gritty of individual mining stocks such as their geology, management, financials, and other specific details.

With over 700 precious metals miners, covering them thoroughly is quite literally a full-time job. We’ve determined that using ETFs is the most effective way to gain exposure to the sector, as it is much more time efficient while this bull market accelerates rapidly, diversifies away much of the company-specific risk, and allows us to benefit from the broader bull market in precious metals and miners.

And while we don’t recommend this as general advice, we personally use margin to amplify returns if additional leverage is needed. This further reduces the advantages of picking individual mining stocks, such as their potential for greater gains compared to ETFs.

Also, we must point out that other newsletters and analysts who take a bottom-up stock-picking approach to miners, with a heavy focus on management and geological aspects, almost never have the big-picture macroeconomic understanding and “market sense” that we do. It is usually one or the other, as it is very difficult and rare to master both. In fact, we are not aware of any analysts or newsletters that have expertise in both areas.

We decided to focus on what we do best, and it has proven to be a winning formula both in terms of the success of this newsletter and our investment returns.

That said, for those who are still interested in investing and trading specific mining stocks rather than ETFs, our macro precious metals and mining sector analyses are highly useful for that purpose as well.

Bullish signals in the broader precious metals market and mining sector often carry over into individual mining stocks, as they tend to rise and fall together. As the saying goes, “a rising tide lifts all boats.” Many of our subscribers use that very approach successfully to make life-changing investment decisions and have told us so.

Our prescient calls on gold, silver, and the broader mining sector, including calling the start of gold’s bull market on March 1st, 2024, just hours before it began (browse our calls here), have all carried over into individual mining stocks as well.

The bottom line is that you can’t truly understand mining stocks without first having a solid grasp of the gold and silver market itself, and that’s exactly what we bring to the table.

• Do you offer a chat room for subscribers?

After experimenting with Substack’s chat feature, we decided to disable it for the time being. We realized that when we have something important to say, we prefer to publish a full post that reaches all paid subscribers.

Since only a small percentage of subscribers saw or engaged with the chat, it started to feel redundant and more like a distraction from the newsletter.

In addition, the chat is quite limited in terms of the kinds of complex thoughts, charts, and data that can be conveyed there, unlike full newsletter posts.

Plus, the chat was attracting spam from people promoting their own content, and conversations often veered off into random topics. That required moderation, and we simply don’t have the time or energy for that while also researching and writing in-depth reports, responding to comments on each newsletter post, and keeping up with a high volume of direct messages and emails every day.

It was turning into a three-ring circus, so we decided to temporarily disable the chat until we can bring on more staff to help manage our growing media presence.

If we can’t do something with excellence, we’d rather not do it at all.

The good news is that Substack chats can always be restarted, and we’re open to bringing it back in the future.

• Does this newsletter have a political bias?

We steer clear of partisan, left-versus-right, us-versus-them politics as much as possible. We’re critical of both major parties and take a skeptical view of politicians and government across the board.

The author of this newsletter, Jesse Colombo, is an “Austro-libertarian,” meaning he adheres to Austrian School economics, takes a libertarian approach to politics and government, and is a strong advocate of free markets and sound money.

• Who is this newsletter intended for?

While this newsletter is valuable for all investors and concerned citizens, it’s especially geared toward long-term gold and silver investors, as well as investors in gold and silver mining stocks.

A key reason behind this newsletter’s success is Jesse’s unique talent for breaking down complex financial and economic concepts into clear, easy-to-understand language, always paired with compelling visualizations.

His content is designed for readers from all walks of life, from plumbers and police officers to doctors, engineers, and financial professionals, unlike many other financial newsletters that are filled with unexplained jargon and seem written only for industry insiders.

That said, this newsletter is not solely about precious metals. We also analyze and track major financial markets to provide a comprehensive view of the global economic landscape.

This newsletter is focused on delivering high-quality research, analysis, and insights on precious metals, the global economy, and major economic risks, paired with an educational approach aimed at teaching, guiding, and empowering precious metals investors of all experience levels.

While we legally can’t and don’t provide personalized investment or financial advice, the insights you’ll gain from this newsletter will help you become significantly more informed, putting you in a stronger position to make smarter investment decisions and avoid the major risks that mainstream media and economists are overlooking.

• Who is this newsletter not intended for?

As mentioned in the previous section, The Bubble Bubble Report is especially tailored for patient, long-term gold and silver investors, along with investors in gold and silver mining stocks.

While we do analyze financial markets from both tactical and strategic perspectives, this newsletter doesn’t focus on publishing frequent trading signals, market timing, guided trading, hot stock tips, or anything resembling a “get rich quick” approach.

In general, short-term trading is highly risky and unsuitable for most investors, and providing trading advice simply isn’t the kind of business we want to be involved in, given how much of a minefield it is.

While bullion stacking and long-term mining stock investing may not appeal to the “get rich quick” crowd, we believe it actually is one of the most exciting and lucrative opportunities of our time.

Jesse expects gold to soar to at least $20,000 an ounce and silver to over $500 an ounce in the coming years, with many mining stocks poised to deliver even greater percentage gains thanks to their natural leverage to metals prices.

This newsletter is focused on those exciting long-term opportunities, not on rapid-fire trading.

• I have further questions. How can I contact you?

You can contact us through Substack’s direct message feature or by emailing jesse [at] thebubblebubble.com. We’ll do our best to answer your questions and assist you.

Disclaimer: the information provided by Jesse Colombo, The Bubble Bubble Report, and related content is for informational and educational purposes only and should not be construed as investment, financial, or trading advice. Nothing in this publication constitutes a recommendation, solicitation, or offer to buy or sell any securities, commodities, or financial instruments.

All investments carry risk, and past performance is not indicative of future results. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher disclaim any liability for financial losses or damages incurred as a result of reliance on the information provided.