The Bubble Bubble Report is a bestselling Substack newsletter with over 8,500 subscribers, specializing in precious metals and major global economic risks including credit and asset bubbles.

Jesse Colombo, the publisher of this newsletter, is a precious metals analyst, investor, and writer—and a strong advocate for free markets and sound money—with a large online following across platforms like X/Twitter, LinkedIn, and Facebook.

In 2008, Jesse was recognized by the London Times for predicting and warning millions of people about the upcoming Global Financial Crisis (click here to learn more).

Jesse is frequently quoted in the media, and his research is widely published on leading sites such as ZeroHedge, Kitco, The Jerusalem Post, Money Metals Exchange, Gold-Eagle.com, GoldSeek.com, SilverSeek.com, King World News, Forbes, GATA.org, MiningFeeds.com, and many others.

Jesse has an exceptional track record as a market analyst—including accurately predicting gold’s $1,500 surge in 2024 just hours before it took off (see here), and anticipating the 2025 stock market selloff days before it began (see here).

If everything above resonates with you, we invite you to click the button below and upgrade to a full paid subscription to The Bubble Bubble Report for just $15 a month→

Frequently Asked Questions (FAQs):

• What does The Bubble Bubble Report cost?

A premium subscription is just $15/month—or only $13.33/month with the annual plan.

It’s a small price to pay for cutting-edge financial insights from one of the most accurate precious metals analysts in the business.

• What is included in a paid membership?

We aim to publish at least three high-quality, visually rich reports, articles, or market analyses each week—totaling around twelve per month, and often more when market activity heats up.

We also publish free reports several times a month for the benefit of all subscribers—both paid and free.

Paid subscribers also gain full access to all archived content.

We also offer a private chat exclusively for free subscribers, where Jesse frequently shares timely market alerts and quick commentaries throughout the day—perfect for staying nimble without waiting for a full-length report.

This newsletter combines fundamental economic analysis with technical and chart-based analysis to get the best of both worlds. We’ve found this blended approach to be highly effective and believe neither method should be used in isolation.

• How can I upgrade from a free to a paid subscription?

First, make sure you're signed into Substack, then just click here and follow the simple steps.

• How can I unsubscribe or cancel my subscription?

Whether you're a free or paid subscriber to The Bubble Bubble Report, you can unsubscribe or cancel your subscription at any time — and it’s quick and easy to do:

If you're a free subscriber, click here for easy instructions on how to unsubscribe

If you're a paid subscriber looking to cancel your subscription, click here

• Can I see some examples of your content?

Yes, here are some examples of reports we’ve published in the past few months:

Gold's Breakout Across Major Currencies Paves the Way for a Surge to $3,000

Here's What the U.S. Presidential Election Means For Gold & Silver

We combine fundamental economic analysis with technical (chart-based) analysis to get the best of both worlds. We’ve found this approach to be highly effective and believe neither should be used in isolation.

• What’s the philosophy and angle behind this newsletter?

This newsletter specializes in gold and silver investing while uncovering and exposing major financial and economic risks—including dangerous bubbles in debt and asset prices—that will trigger a devastating crash in markets and a global depression in the not-too-distant future.

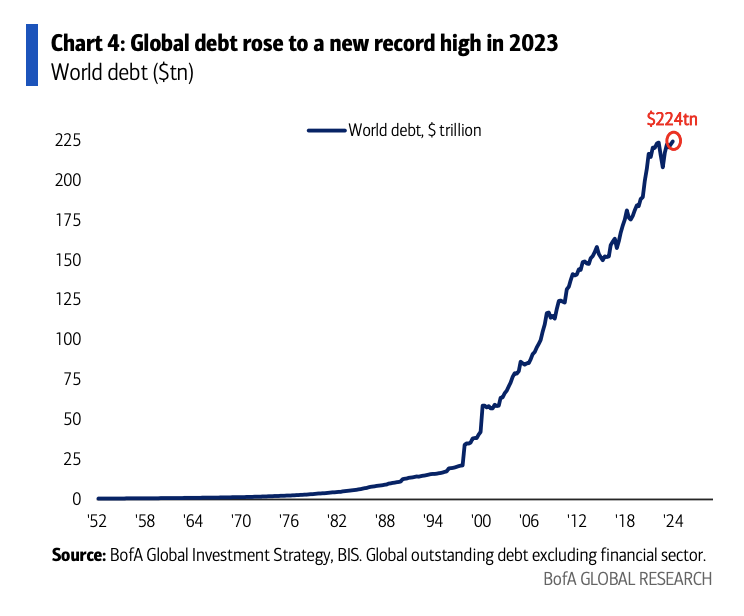

For example, total outstanding global debt has exploded 10-fold since the late 1990s, reaching $224 trillion—and it’s a massive bubble that’s destined to burst and bring the global economy to its knees:

Another major bubble is in the U.S. stock market, with numerous indicators revealing how outrageously overvalued it is — including billionaire investor Warren Buffett’s 'favorite indicator,' the total U.S. stock market capitalization-to-GDP ratio, which shows that stocks are even more expensive now than they were during the late 1990s dot-com bubble that ended in a devastating crash — and unfortunately, this time will be no different:

As if those two bubbles aren’t alarming enough — wait, there’s more!

Another major bubble has formed in U.S. housing, with inflation-adjusted home prices now exceeding the peak of the mid-2000s housing bubble that triggered the 2008 crash.

Clearly, we didn’t learn from the last experience and are repeating the same mistakes — and once again, this bubble will burst with devastating consequences in the coming economic downturn.

In addition to those three bubbles, Jesse also warns of numerous other dangerous bubbles forming around the world—including in the technology sector, startups and venture capital, private equity, U.S. wealth, corporate debt, auto loans, credit card debt, higher education, healthcare, and major property markets in Canada, Australia, Western Europe, and China.

The eventual bursting of these bubbles will result in a depression even more devastating than the Great Depression of the 1930s.

Jesse’s The Bubble Bubble Report newsletter actively tracks and analyzes all of these growing risks to keep subscribers informed and ahead of the curve.

While Jesse firmly believes that mainstream financial markets are headed for a major crash, he sees physical gold and silver bullion as the best way to protect and grow wealth during the coming turmoil—and he writes heavily from that perspective.

He also believes in holding select high-quality gold and silver mining stocks for their potential to deliver significant upside and will be sharing more about that topic going forward.

Jesse is also a survivalist and prepper (check out this TV interview), and he plans to create more content on that topic going forward—focusing on how to survive and thrive when the global economic bubble inevitably bursts.

• Does this newsletter have a political bias?

We steer clear of partisan, left-versus-right, us-versus-them politics as much as possible. We’re critical of both major parties and take a skeptical view of politicians and government across the board.

The author of this newsletter, Jesse Colombo, is an “Austro-libertarian”—a believer in Austrian School economics, a libertarian approach to politics and government, and a strong advocate of free markets and sound money.

• Who is this newsletter intended for?

While this newsletter is valuable for all investors and concerned citizens, it’s especially geared toward long-term gold and silver investors, as well as investors in gold and silver mining stocks.

A key reason behind this newsletter’s success is Jesse’s unique talent for breaking down complex financial and economic concepts into clear, easy-to-understand language—typically paired with compelling visualizations.

His content is designed for readers from all walks of life—from plumbers and police officers to doctors, engineers, and financial professionals—unlike many other financial newsletters that are filled with unexplained jargon and seem written only for industry insiders.

That said, this newsletter is not solely about precious metals—we also analyze and track major financial markets to provide a comprehensive view of the global economic landscape.

This newsletter is focused on delivering high-quality research, analysis, and insights on precious metals, the global economy, and major economic risks—paired with an educational approach aimed at teaching, guiding, and empowering precious metals investors of all experience levels.

While we legally can’t and don’t provide personalized investment or financial advice, the insights you’ll gain from this newsletter will help you become significantly more informed—putting you in a stronger position to make smarter investment decisions and avoid the major risks that mainstream media and economists are overlooking.

• Who is this newsletter not intended for?

As mentioned in the previous section, The Bubble Bubble Report is especially tailored for patient, long-term gold and silver investors, along with investors in gold and silver mining stocks.

While we do analyze financial markets from both tactical and strategic perspectives, this newsletter doesn’t focus on publishing frequent trading signals, market timing, guided trading, hot stock tips, or anything resembling a “get rich quick” approach.

In general, short-term trading is highly risky and unsuitable for most investors, and providing trading advice simply isn’t the kind of business we want to be involved in, given how much of a minefield it is.

While bullion stacking and long-term mining stock investing may not appeal to the "get rich quick" crowd, we believe it actually is one of the most exciting and lucrative opportunities of our time.

Jesse expects gold to soar to at least $15,000 an ounce and silver to over $300 an ounce in the coming years, with many mining stocks poised to deliver even greater percentage gains thanks to their natural leverage to metals prices.

This newsletter is focused on those exciting long-term opportunities—not on rapid-fire trading.

• Why should I give your newsletter a try?

For just $15 a month—about 50 cents a day, less than the cost of a cup of coffee—you can try out this newsletter for a month and see if it’s right for you→

It’s a small price to pay for cutting-edge financial and economic research that’s avidly read by numerous leaders in the precious metals and natural resources sector—including at least four billionaires.

And in the worst-case scenario, if you decide it’s not for you, you’re free to cancel and you’ll only be out $15.

It’s a classic high-reward, low-risk proposition you’ll regret not taking advantage of—after all, the greatest risk is not taking one.

• Who is Jesse Colombo?

Jesse Colombo is an economic analyst, private investor, and publisher of the bestselling newsletter The Bubble Bubble Report, which has over 7,000 subscribers.

Jesse is a popular financial media personality with over 250,000 social media followers and millions of views per month on all platforms (you can follow him on social media as well: X/Twitter, LinkedIn, and Facebook).

Jesse describes himself as an “Austro-libertarian,” meaning he adheres to Austrian School economics, embraces a libertarian philosophy on politics and government, and strongly advocates for free markets and sound money.

Jesse wrote an online column for Forbes from 2013 to 2024.

In 2008, he was recognized by The Times (of London) for anonymously warning millions of people about the U.S. housing and credit bubble as a university student via a website he built called "stock-market-crash.net."

In 2005, the LA Times recognized Jesse’s site as one of the four most highly-trafficked housing bubble-related websites.

Jesse earned a Bachelor of Science with cum laude honors from SUNY Stony Brook University in 2008.

• I have further questions. How can I contact you?

You can contact us through Substack’s direct message feature or by emailing jesse [at] thebubblebubble.com. We’ll do our best to answer your questions and assist you.

Disclaimer: the information provided in The Bubble Bubble Report and related content is for informational and educational purposes only and should not be construed as investment, financial, or trading advice. Nothing in this publication constitutes a recommendation, solicitation, or offer to buy or sell any securities, commodities, or financial instruments.

All investments carry risk, and past performance is not indicative of future results. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher disclaim any liability for financial losses or damages incurred as a result of reliance on the information provided.