Is This Market Rebound Just a Dead Cat Bounce?

Despite the recent pullback, the U.S. stock market remains extremely overvalued—and overeager amateur investors are ignoring that reality as they foolishly rush back into stocks.

What a difference a month makes. Just weeks ago, the stock market was in freefall, fear dominated the headlines, and we were bombarded with tariff-related announcements that left investors scrambling to interpret their impact. Since then, the Trump administration softened its approach on tariffs in response to the markets’ sharp reaction. Fear has quickly faded, and now stocks—and other risk assets—are rallying as retail investors rush to "buy the dip," convinced that the worst is behind us. But as I’ll show in this article, that confidence is gravely misplaced—and a costly lesson is just around the corner.

To start, U.S. recession odds for 2025—according to prediction markets Polymarket and Kalshi—have dipped from a peak of 68% on May 1st to 59%, reflecting a boost in sentiment. Unfortunately, the odds remain high and align with the recession warning signs I’ve been highlighting for some time—signs that predate the Trump presidency. In my view, a recession was inevitable no matter who took office—Trump, Harris, or anyone else—because the underlying economic problems go far beyond the current tariff drama.

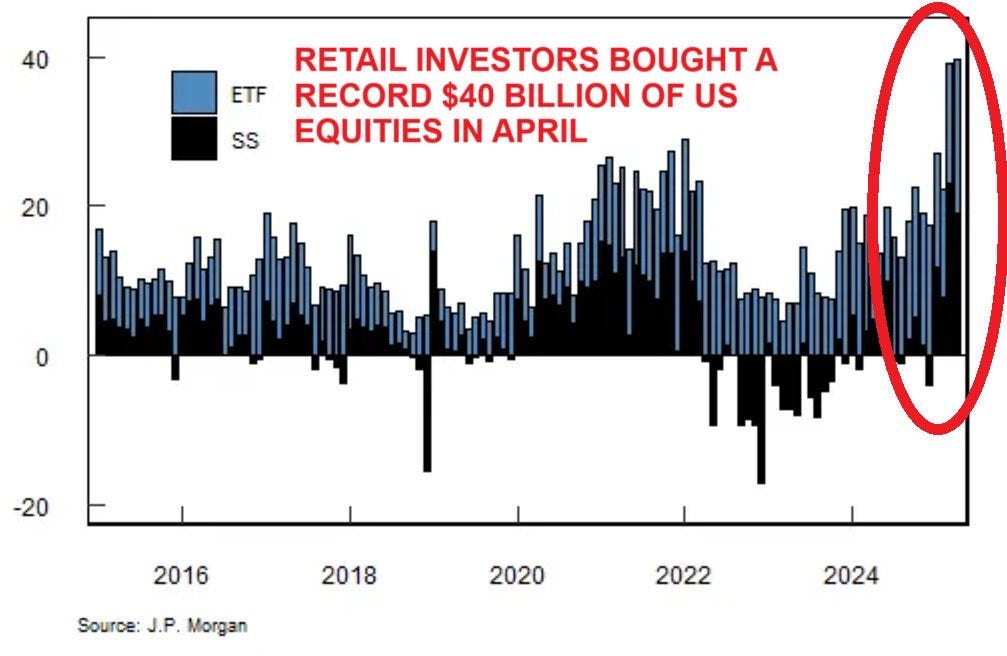

Over the past few weeks, one group has stood out for its overwhelming optimism about the stock market: retail investors. In April alone, they poured a record $40 billion into U.S. stocks—even as institutional investors continued to sell. That’s a major red flag for the sustainability of this rebound. Retail investors—often referred to as "dumb money"—are the least informed and are typically on the wrong side of major market turning points. Meanwhile, institutional investors—the so-called “smart money”—aren’t convinced this rally is for real. And neither am I.

It’s important to remember that all bear markets include powerful rallies (or dead cat bounces) that lure retail investors back in—only for the market to resume its decline. Retail investors are often too eager to “buy the dip,” believing that stocks will keep rising almost indefinitely. Unfortunately, they learn the hard way.

The chart below shows how the dot-com bubble burst in 2000, with multiple dead cat bounces along the way down. Unless proven otherwise, the evidence indicates that the current bounce is merely a bear market rally—as I’ll show throughout this piece.

Now let’s turn to the charts, starting with the bellwether S&P 500. Here’s what stands out: despite the sharp rebound over the past few weeks, the rally has only brought the index just shy of the major 5,800 to 6,600 resistance zone. That means the broader technical breakdown from recent months remains firmly intact.