Stocks Continue to Sink as Recession Risk Soars

The U.S. stock market situation continues to deteriorate, with few—if any—credible signs of relief on the horizon.

It was another brutal day in the markets, despite a sharp rally in the morning that had major indices soaring. The S&P 500, for instance, was up as much as 4.05% as investors briefly celebrated, hoping the recent market plunge had bottomed out and a relief rally was underway. But as the day wore on, those gains evaporated just as quickly as they appeared, with optimism fading over any potential U.S. delays or concessions on looming tariffs ahead of a midnight deadline. By the close, the S&P 500 had reversed sharply to end down 1.51%, the Dow slipped 0.79%, and the tech-heavy Nasdaq 100 dropped 1.82%. It marked the worst intraday reversal from gains to losses since October 14, 2008—during the darkest days of the Global Financial Crisis.

Today’s market plunge adds to a string of brutal months that have erased over $10 trillion in market capitalization. The S&P 500 heatmap from the past week tells the story: nearly every sector and stock is deep in the red. Notable names took especially hard hits—Apple dropped a staggering 22.75% (no surprise to those who read my March 29th update), Tesla fell 17.36%, Nvidia lost 12.57%, Facebook parent Meta declined 12.89%, Bank of America sank 15.57%, JPMorgan slid 10.99%, Chevron plunged 18.74%, and ExxonMobil tumbled 15.35%:

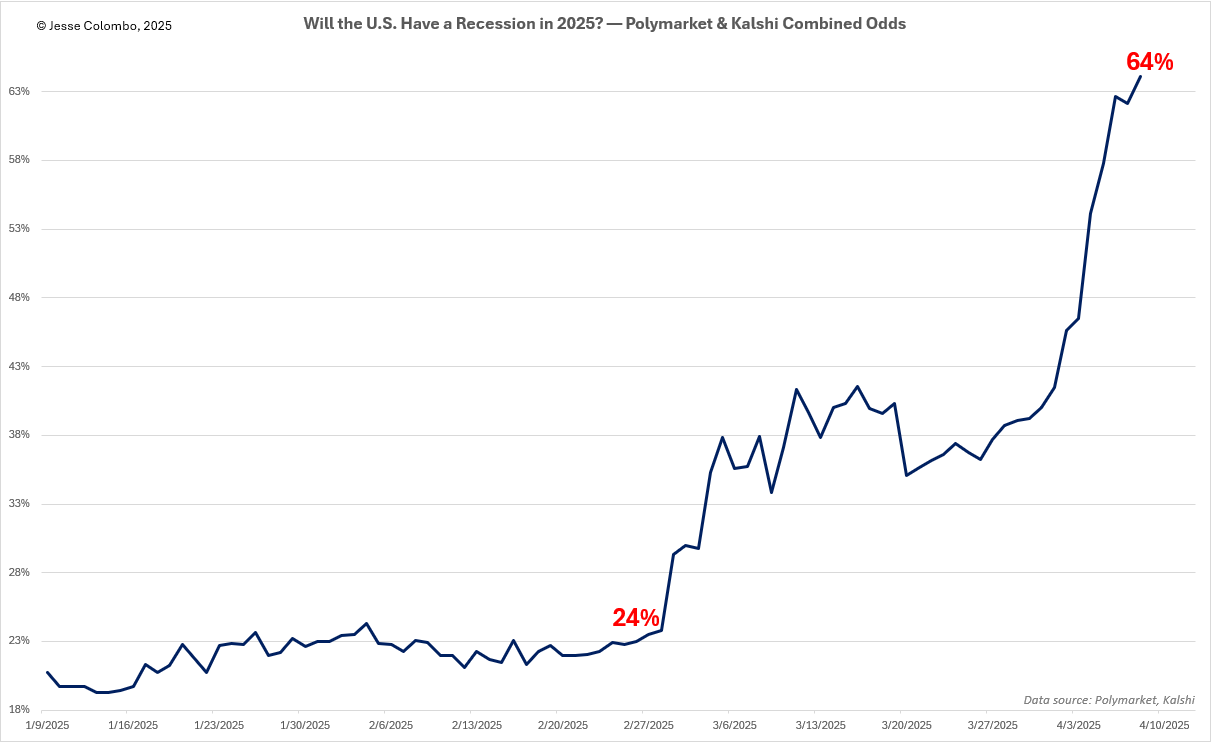

As the rancorous back-and-forth over tariffs between the U.S. and its major trading partners intensifies—and the threat of a full-blown trade war looms—stocks are plunging and the odds of a recession this year are soaring. This spike in recession risk is reflected across a range of indicators, including prediction markets like Polymarket and Kalshi, which I’ve averaged and plotted in a single chart below. It's worth noting: this rise in recession risk is something I’ve been warning about since the calm, almost idyllic days of December—long before the current tariff shock hit the markets.

Further evidence that a recession is becoming increasingly likely can be seen in rapidly falling inflation expectations. Multiple indicators are flashing warning signs, including the 5-year breakeven inflation rate (shown below), the ProShares Inflation Expectations ETF, and Truflation—which draws from over 13 million data points across 30+ sources to produce daily-updated inflation indexes. Historically, inflation tends to decline during recessions as economic activity and consumer spending slow, leading to reduced demand for goods and services.

Another classic warning sign of a looming recession and financial stress is the blowout in high-yield spreads—also known as credit spreads. These represent the difference in yields between high-yield (or "junk") bonds and safer benchmarks like U.S. Treasuries, reflecting the extra compensation investors demand for taking on greater default risk. A widening spread signals rising fear and tightening credit conditions. This is a key chart—and a critical trend—to keep a close eye on.