Surging U.S. Inflation Expectations Propel Gold Higher

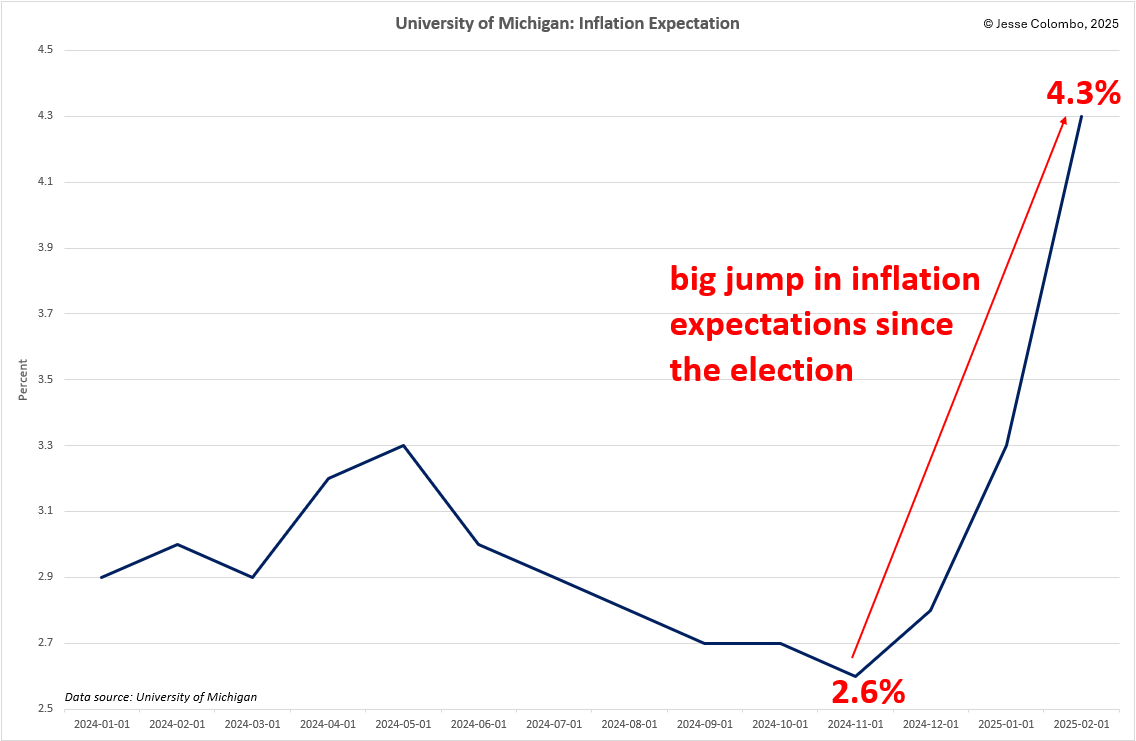

Amid growing tariff concerns, U.S. consumers now anticipate 4.3% inflation over the next 12 months—a sharp 1 percentage point increase since January.

Since President Trump took office and introduced his policies, financial markets have faced a wave of uncertainty, driven by a mix of complex and often conflicting forces. This volatility has led to choppy market conditions, but for precious metals investors, uncertainty has been a boon. Over the past month, gold has surged by approximately $200, while silver has climbed $3, or 10%. One key driver behind this rally is rising U.S. inflation expectations, as newly released data confirms.

U.S. consumers' 12-month inflation expectations jumped to 4.3% in February, the highest level since November 2023, according to the University of Michigan’s monthly consumer sentiment survey. This 1.7 percentage point surge over the past three months is the sharpest increase since February 2020. The primary driver behind this spike is growing concern over President Trump’s tariff policies and their potential to trigger trade wars and drive inflation higher—a topic I covered in detail just a few days ago.

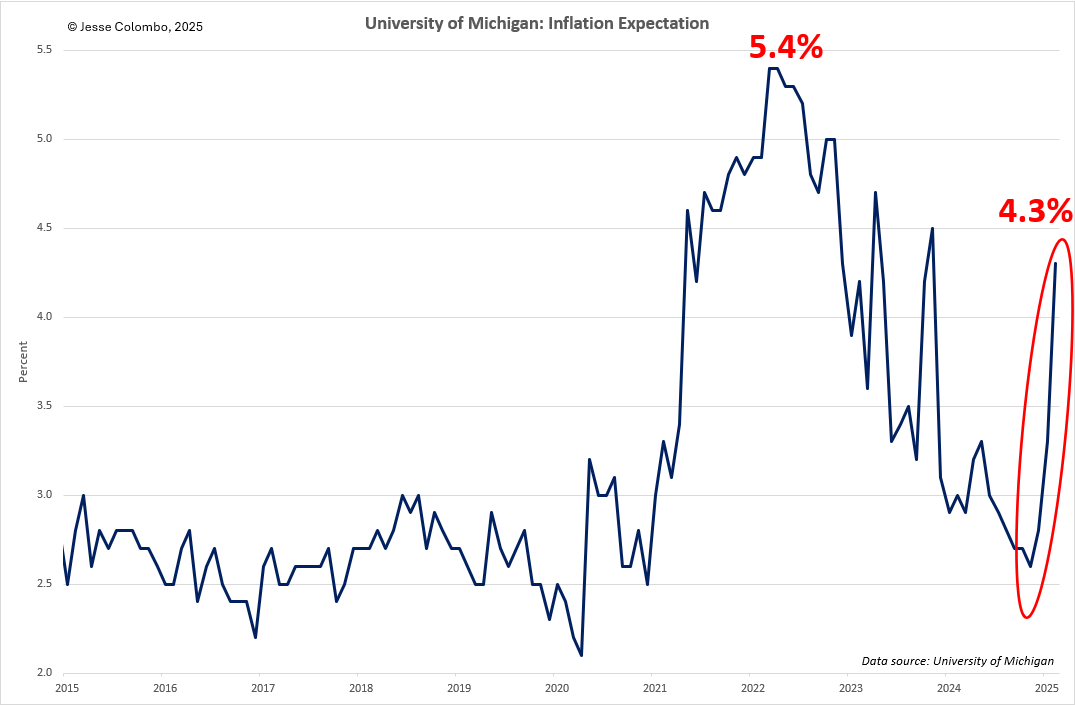

A decade-long chart of inflation expectations highlights the significance of February’s sharp jump. At 4.3%, we are now just 1.1 percentage points below the peak of 5.4% seen in March and April 2022—when inflation, particularly soaring gasoline prices, fueled the height of the 'Let’s Go Brandon' protest movement.

The recent surge in inflation expectations is further confirmed by other indicators, such as the 5-year inflation breakeven rate. This rate, calculated as the difference between the yield on a nominal 5-year U.S. Treasury note and a 5-year Treasury Inflation-Protected Security (TIPS), reflects the market’s forecast for average annual inflation over the next five years.

Other market-based indicators also reflect rising inflation expectations, such as the ProShares Inflation Expectations ETF (ticker symbol: RINF). This exchange-traded fund moves in tandem with inflation expectations, rising when they increase and falling when they decline. As shown in the chart below, RINF has been trending upward in recent months, mirroring the rise in the 5-year inflation breakeven rate.

Finally, commodity prices—one of the most traditional indicators of inflationary pressures—have been climbing in recent months. The S&P Goldman Sachs Commodities Index (S&P GSCI) has been rising, reinforcing the signals from other inflation indicators.

With multiple indicators pointing to rising inflation over the next year, it's no surprise that gold has surged since December, as I discussed in a recent article. Given these trends, there’s a strong likelihood that gold will push toward $3,000 and beyond in the near future.

After much speculation and negotiation, President Donald Trump agreed to delay the 25% tariffs initially imposed on Canada and Mexico. However, it's important to remember that this is merely a delay—not a cancellation. These tariffs could easily return in a month or two. Meanwhile, the 10% tariff on all imports from China remains in effect. Additionally, Trump has stated that tariffs ‘will definitely happen with the European Union’ and could take effect ‘pretty soon,’ though no concrete plans have been announced yet.

Inflation expectations have been rising in response to tariff risks because companies facing higher import costs typically pass some or all of these expenses on to consumers, driving prices higher. Additionally, the likelihood of a broader trade war increases as other countries retaliate with tariffs of their own—a process already underway with China. Fortunately for precious metals investors, these developments have been a tailwind for gold and silver and should be for the foreseeable future.

I’m pretty sure tariffs will just make inflation much worse. At least we have a 1 month reprieve. I hope folks are stocking up on food and essentials. The graphs that you posted show us just how bad it is. It might even be worse then we know. I have followed and believe John Williams shadowstats.com website for years!

Thought you might be interested in the following, as I am in the UK.

Keir Starmer is gathering his Cabinet for a crisis meeting as the threat of 'Stagflation' rises.

The special meeting with ministers is taking place to 'take stock' after the Bank of England halved growth forecasts for this year from 1.5 per cent to 0.75 per cent.

It was also announced on Thursday 6th Feb 2025 that interest rates had been cut from 4.75 per cent to 4.5 per cent.

However, the Bank of England warned that inflation had eased much more slowly than hoped.

The changes come after Chancellor Rachel Reeves confirmed major tax increases in the October Budget as well as rising energy and water costs. Oh deep joy!

There are now fears that extra tax increases or spending cuts are on the way as the government continues to fill a hole in public finances.

Economists suggested the UK is heading towards 'Stagflation', with the economy flatlining while inflation pressures continue to grow. And - you ain't seen nothing yet - just like Silver will rise from the ashes phoenix like - eventually!

Charlie.

Lowercosta.com