The Growing Risk of Stagflation Bodes Well For Gold & Silver

Persistent inflation, coupled with a likely impending recession, is a recipe for stagflation.

In recent articles, I’ve highlighted the surge in U.S. inflation expectations over the past few months and how this has been a bullish driver for gold and silver. Today, the U.S. Consumer Price Index came in hotter than expected, reinforcing those inflation concerns and raising the specter of stagflation as economic growth slows and layoffs increase. While these developments are troubling for the broader economy, they create a highly favorable environment for precious metals, which I will explore in this article.

This morning’s report showed that the Consumer Price Index (CPI) rose at an annual rate of 3.0% in January, surpassing the expected 2.9%. Meanwhile, the core CPI, which excludes volatile food and energy prices, climbed 3.3% annually—higher than the anticipated 3.1%. The Federal Reserve generally targets a 2% inflation rate, yet as the chart below illustrates, core CPI annual growth rate remains persistently elevated, standing 62% above its pre-pandemic average. Adding to concerns, January’s data was recorded before President Trump’s tariffs took effect, suggesting inflationary pressures could intensify in the coming months.

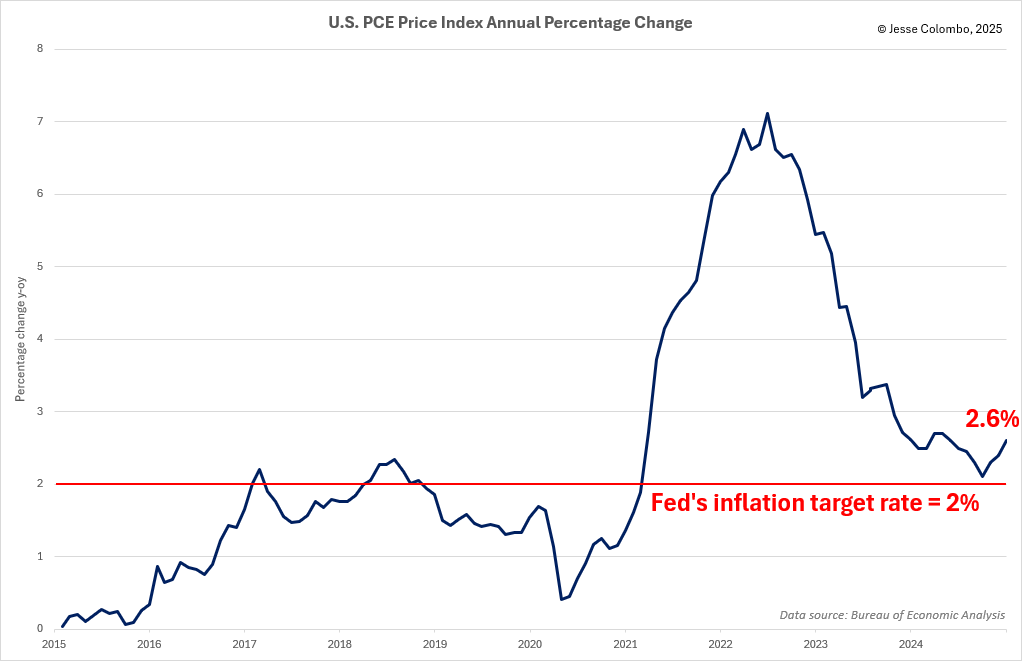

While the Consumer Price Index (CPI) is the most widely recognized measure of inflation, the Federal Reserve’s preferred gauge is the Personal Consumption Expenditures (PCE) price index. In December, the PCE rose at an annual rate of 2.6%, reinforcing the same message as the CPI—inflation remains persistently high and has been trending in the wrong direction in recent months.

The increase in the inflation rate was anticipated by several inflation expectation indicators, including the 5-year inflation breakeven rate, as shown in the chart below. This rate, calculated as the difference between the yield on a nominal 5-year U.S. Treasury note and a 5-year Treasury Inflation-Protected Security (TIPS), reflects the market’s forecast for average annual inflation over the next five years. What’s especially concerning is the spike since late January, reflecting the market’s anticipation of the inflationary impact of the upcoming tariffs.