Understanding the Current Silver Squeeze

The silver shortage in London is only a small glimpse of what lies ahead when the paper silver system unravels and a frantic rush begins for the extremely limited supply of physical silver.

After languishing for much of 2024 and early 2025 while gold soared, silver is finally coming into its own in a big way, surging nearly 60% over the past five months and shaking off its reputation as a sluggish investment. On Friday, it closed at an all-time high above $50, a price level that, as I recently explained, brought the bull markets of 1980 and 2011 to an abrupt halt. On top of that, there are now abundant signs that the physical silver market is buckling under stress, with clear indications of a silver squeeze or shortage taking shape. In this piece, we’ll take a look at what’s happening and how this squeeze is likely to resolve.

For now, the squeeze is primarily centered in the wholesale London bullion market, where the dominant form of silver traded is the Good Delivery silver bar, weighing 31.1 kilograms or 1,000 troy ounces, as shown in the picture below. These bars must be at least 99.9% pure and produced by refineries approved by the London Bullion Market Association (LBMA). Approved refiners include Argor-Heraeus, Asahi Refining, Heraeus, Metalor, MKS PAMP, the Royal Canadian Mint, and Valcambi, among others.

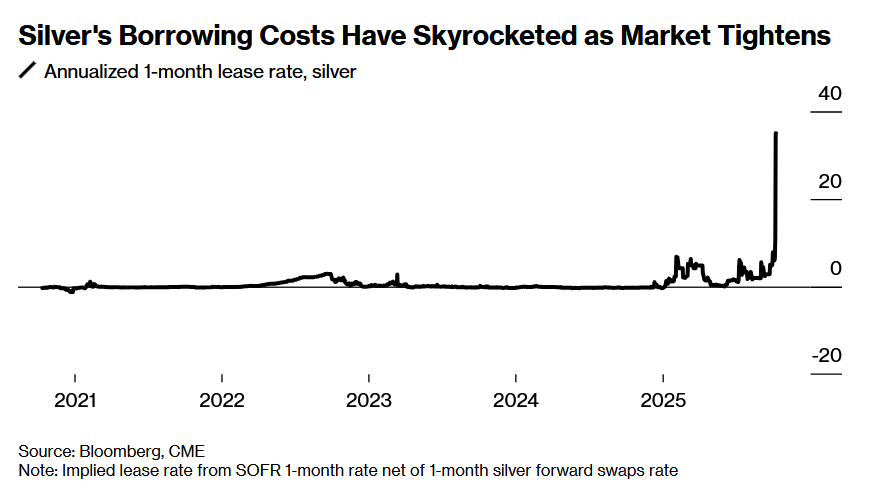

Over the past week, as silver’s price surged, there has been breakneck demand for physical bullion from investors, exchange-traded funds, futures, and other derivatives. This has created a shortage in the already tight London physical bullion market. There are several forms of evidence pointing to this, including soaring lease rates, which represent the annualized cost of borrowing metal in the London market. According to Bloomberg, those rates have jumped as high as 30% in recent days. That is a clear and unmistakable sign of stress in the physical silver market, and it’s something worth paying close attention to.

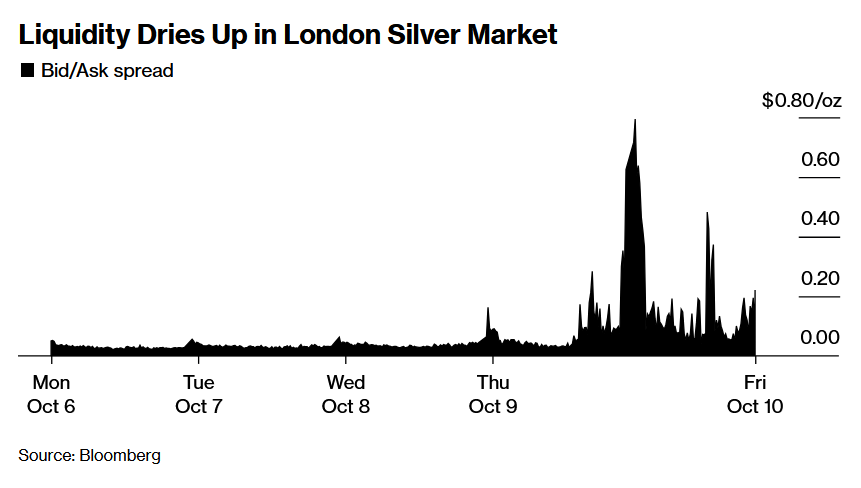

Further evidence of stress in London’s physical silver market can be seen in the widening bid-ask spreads for spot silver. These spreads, which typically hovered around 3 cents per ounce, have now spiked to well over 20 cents.

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask). It functions as a transaction cost and is usually earned by the market maker for providing liquidity and facilitating the trade.

Even more evidence of stress can be seen in the recent spike in the spread between the London spot price of silver and the New York price, as represented by COMEX silver futures. This spread, which normally sits around minus $0.30 per ounce with futures trading slightly higher, jumped to an extraordinary $3 per ounce, with the London spot price actually exceeding the futures price.

This unusual condition is known as backwardation, a market situation where the spot price of a commodity is higher than its futures price. It signals a supply shortage and strong immediate demand. The last time a backwardation of this magnitude occurred in the silver market was in 1980, during the Hunt Brothers’ attempt to corner the silver market.

The intraday chart from the past week highlights the sharp surge that developed in the spread between the London spot price of silver and the New York futures price: