Gold Warns the U.S. Government and Fed Are Losing Control

Gold’s surge over the past year isn’t signaling the start of a new golden age — it’s warning of a looming fiscal and currency crisis as governments and central banks lose control.

Gold has a remarkable track record of warning about—and hedging against—major threats well before the public catches on, whether it’s recessions, inflation, or geopolitical turmoil. Another critical warning it provides is when major governments and central banks start losing control—usually a precursor to full-blown crises. That’s a theme my fellow blogger Mike “Mish” Shedlock frequently explores — including in a compelling post he published today titled “Gold Soars to Another New High: What’s the Message?” This piece resonated with me, so I’m sharing one of his charts, some of his insights, and then adding my own commentary.

Shedlock created the fascinating four-decade gold chart below, which highlights how major moves in gold often correlate with rising or falling confidence in central banks—particularly the U.S. Federal Reserve. He illustrates how the roughly $1,500 per ounce surge over the past year reflects gold sensing that the Fed is losing control.

Markets are now anticipating a return to quantitative easing (QE), which is essentially digital money printing, and other forms of stimulus as the Fed scrambles to manage mounting risks — from Housing Bubble 2.0 (which I’ve covered here) to an impending fiscal crisis and more.

Shedlock — a fellow libertarian — argues in today’s piece that gold’s surge is signaling three key risks: it doesn’t trust that the Fed is in control, it doesn’t trust that Congress is in control, and it doesn’t trust that Trump is in control. He goes on to say that neither Congress, the so-called Department of Government Efficiency (DOGE), nor Trump will do anything meaningful about the soaring deficits; that tariffs won’t offset the massive spending Trump demands and Congress enables; and that the Fed won’t stop monetizing the debt. I have to say — I agree with him on all counts.

Shedlock points out that even larger U.S. budget deficits are now inevitable, driven in part by the first-ever $1 trillion defense budget — which dwarfs DOGE’s supposed $150 billion in savings, only about $12 billion of which is actually real. He also criticizes U.S. Secretary of Commerce Howard Lutnick for claiming that tariffs could replace the IRS and balance the budget.

He concludes that neither Congress nor Trump has the political will to rein in the exploding deficits and warns that a currency crisis is unavoidable. I agree with that assessment and have recently argued that the U.S. dollar is heading for a major bear market—a scenario that would be extremely bullish for precious metals and commodities.

The reality is that gold is flashing a clear warning about the deteriorating U.S. fiscal situation. The national debt has now surged to a staggering $36.8 trillion—and it’s growing by roughly $1 trillion every three months. Spending cuts like those proposed or initiated by DOGE, while commendable, are measured in mere billions—with a B—while the debt and deficits are measured in trillions—with a T. To make matters worse, DOGE is now winding down its operations, and Elon Musk is returning full-time to the private sector as CEO of Tesla and his other ventures.

Since the year 2000, the U.S. national debt has surged nearly sixfold—a key reason why gold has been in a powerful long-term bull market, climbing from just $288.12 an ounce to around $3,400 today. Gold is increasingly pricing in the risk of a fiscal and currency crisis, as rising debt levels significantly increase the likelihood of such events. It’s only natural, then, that gold continues to move higher in lockstep with that growing risk.

It’s not just that the U.S. national debt is growing in nominal terms—it’s also rising relative to the size of the underlying economy, as measured by GDP. In 2000, the debt-to-GDP ratio was a manageable 55%, but today it has ballooned to an alarming 120%—the highest in U.S. history outside of a brief, anomalous spike during World War II.

Such a massive debt burden puts the U.S. government—and the country as a whole—in an increasingly precarious position. It limits Washington’s ability to respond to future recessions or national emergencies with meaningful fiscal stimulus. As a result, policymakers will be forced to lean even more heavily on monetary stimulus—in other words, running the printing presses at full speed.

That’s why I believe the next recession, which will involve the bursting of massive bubbles in both the tech sector and housing, will be particularly severe—and extremely bullish for gold and silver.

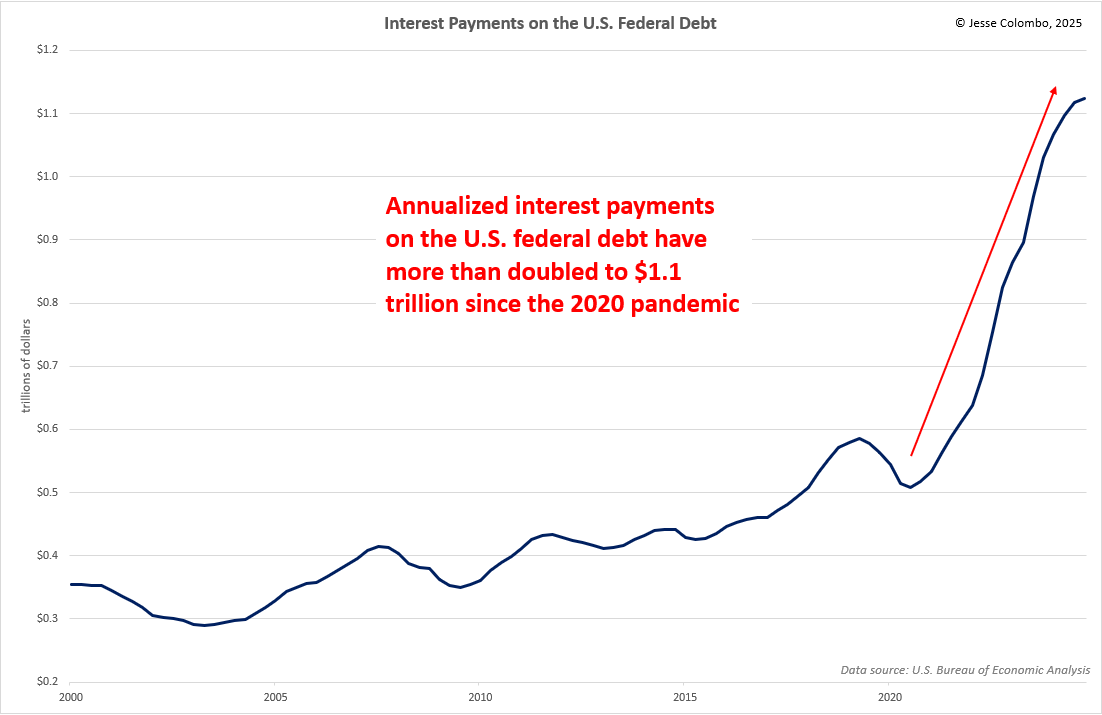

The national debt shouldn’t be viewed in isolation—the cost of servicing that debt through interest payments is just as important to watch. Unfortunately, since the 2020 pandemic, America’s surging national debt, combined with rising interest rates, has more than doubled annual interest payments to over $1.1 trillion. In 2024, gross interest on U.S. debt exceeded spending on defense, income security, health, veterans’ benefits, and even Medicare—making it the second-largest expense for the U.S. government, trailing only Social Security.

And lest you think this is just a U.S. problem—or merely a government issue—think again. It’s a global crisis, with debt piling up across nearly every sector of human activity. This explosion of debt is largely a consequence of our flawed fiat monetary system, which enables unlimited money creation—unlike sound money systems backed by precious metals.

As the chart below shows, total global debt has skyrocketed nearly tenfold since the mid-1990s, reaching $224 trillion by 2023. That’s another major factor fueling gold’s relentless rise over the same period.

Further evidence that global central banks are losing control—and failing at their job —is the explosive growth of the global money supply, which has surged nearly 200% since 2007. This unchecked expansion is fueling major inflation and driving gold higher, as I recently discussed.

Given the increasingly precarious fiscal and monetary landscape since the 2020 pandemic—especially in the world’s leading superpower, the United States—it’s no surprise that many countries, particularly in Asia and emerging markets, have been ramping up their gold purchases.

These nations are strategically diversifying their reserves away from fiat currencies and sovereign debt. Their central banks clearly sense that something major—and destabilizing—is on the horizon. What they’re doing is prudent, and everyday investors would be wise to take note and follow their lead, rather than rushing into speculative tech stocks and cryptocurrencies.

China has emerged as the world’s largest official buyer of gold in recent years, with its central bank accumulating an impressive 346 metric tonnes over the past three years. But it’s not just the government—gold demand runs through every level of Chinese society. Everyday citizens, investment firms, and more recently even insurance companies have been aggressively adding to their gold holdings.

While the West has been largely dismissive of gold—though that’s starting to change —China has remained steadfast in its conviction. That foresight is paying off now as gold surges higher…and just wait until it hits $15,000+ in the next 5 to 10 years, as I expect.

In summary, I fully agree with blogger Mike Shedlock: the U.S. government and Federal Reserve are losing control, and we’re heading straight into a severe fiscal and currency crisis. When that happens, the recent bull markets in gold and silver will look modest by comparison. While many are celebrating what they believe is the dawn of a new golden age, gold’s surge is ironically signaling the exact opposite. Given its proven track record, I’m putting my trust in gold—both as a reliable barometer of looming crises and as the ultimate store of value and safe haven asset.

If you’ve enjoyed this report or have any questions, comments, or thoughts, please give this post a like and share your thoughts in the comments below—I’d love to start a dialogue and hear your perspective.

Disclaimer: the information provided in The Bubble Bubble Report and related content is for informational and educational purposes only and should not be construed as investment, financial, or trading advice. Nothing in this publication constitutes a recommendation, solicitation, or offer to buy or sell any securities, commodities, or financial instruments.

All investments carry risk, and past performance is not indicative of future results. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher disclaim any liability for financial losses or damages incurred as a result of reliance on the information provided.

Good article Jesse, as a Canadian, I am concerned about what will happen to the Canadian dollar and economy in a currency crisis given that the country has no gold.

I appreciate your perspective, and encouragement to stick with, and add to my precious metals positions. A position I have had in PHYS for about 3 years is up 64%, now 18 % of one portfolio. I’m 37% in physical metals, and miner. My advisor thinks I’m crazy, but I’ve been through 2011, and saw silver miners explode. What is going on similar, so I still building my metals positions. I’m in my seventh decade, so this may be my last chance to participate, and I don’t want to miss it. Thank you for helping me avoid the noise. Occasionally I try to tell friends what I believe is happening, and unfortunately few, if any of them understand.