What You Need to Know About the Stock Market Sell-Off

On Monday, a staggering $1.75 trillion was wiped from the U.S. stock market as recession risks surged.

Today was another brutal day for global financial markets, with $1.75 trillion wiped from the U.S. stock market, marking the worst decline of 2025. The S&P 500 fell 2.69%, the Nasdaq 100 plunged 3.84%, and the Dow dropped 891 points (2.08%), while cryptocurrencies also tumbled—Bitcoin lost 3.02%, falling below $80,000, Ethereum dropped 8%, and XRP declined 5.38%. While multiple factors contributed to the sell-off, the biggest driver was the growing realization that a recession is looming—something I’ve been warning about since December, along with the dangers of the U.S. stock market bubble and its inevitable collapse.

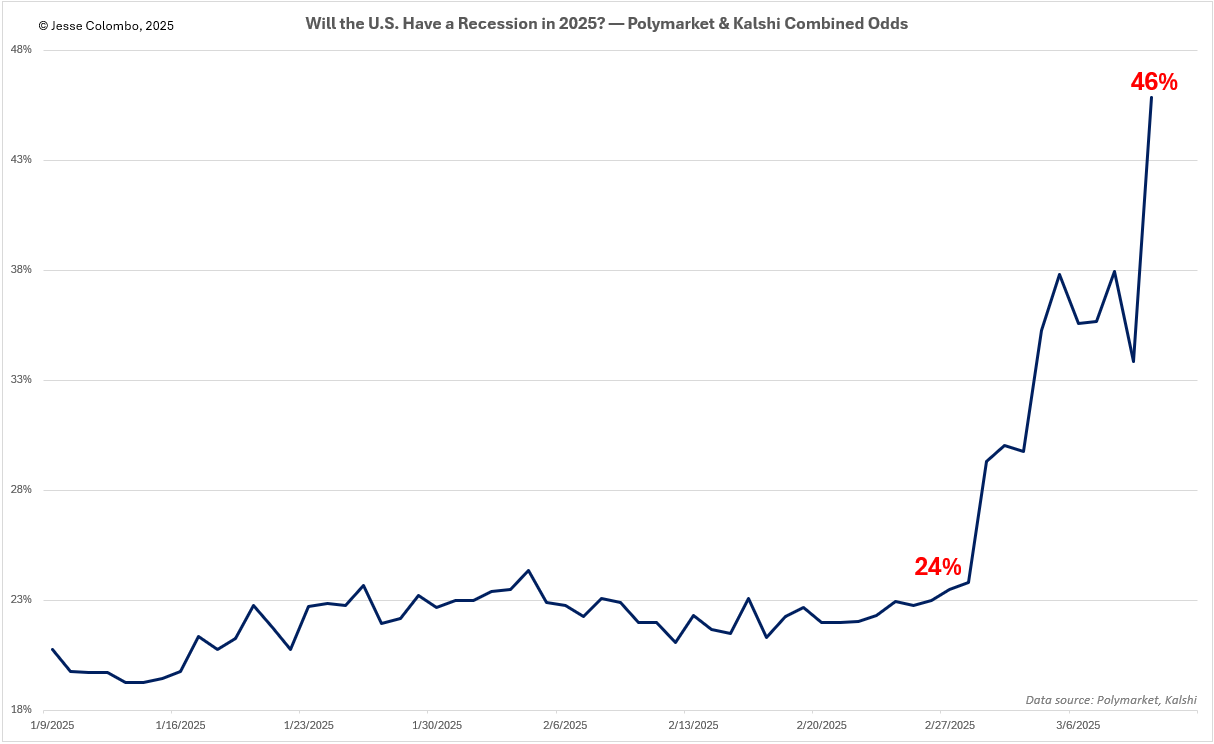

Risk assets like stocks and cryptocurrencies are getting hammered as recession odds surge, as shown in the chart I created. This chart averages recession probabilities from prediction markets Polymarket and Kalshi, platforms where users bet on outcomes ranging from elections to sports and pop culture events. As recently as February 28th, this metric placed the odds of a 2025 U.S. recession at just 24%, but as of today, that number has skyrocketed to 46%. For a deeper dive into why the U.S. is hurtling toward a recession, check out my latest article.

Beyond the rising risk of a recession, earnings estimates are also declining, reinforcing that this downturn isn’t just about liquidity or tariffs—it’s a broader fundamental issue:

Now, let’s examine the technicals, starting with the bellwether S&P 500. For weeks, I’ve highlighted the 5,800–6,000 support zone, warning that a decisive break below this level would confirm an imminent breakdown and the start of a bear market. As of a few days ago, that breakdown has been confirmed, and the risk remains firmly to the downside. Additionally, while many believe this is a prime opportunity to ‘buy the dip,’ I disagree. In my Sunday article, I provided clear evidence showing that bearish sentiment persists for an extended period while bubbles deflate, making blind dip-buying a dangerous strategy.

The tech-heavy Nasdaq 100 recently broke below the critical 20,750–21,000 support zone I’ve been tracking, confirming a significant technical breakdown. At this point, I don’t see any clear or major support levels, meaning the path of least resistance remains to the downside for now.

The Nasdaq 100—and the broader market—has been heavily driven by the "Magnificent 7" stocks: Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla. A key gauge of their performance is the MAGS ETF, which tracks this group. In my recent updates, I identified $53 and $50 as critical support levels, warning that a decisive close below them would signal further declines. Unfortunately, that breakdown has now been confirmed, as the ETF has fallen below both levels. With no clear support in sight, the risk remains firmly to the downside for now.

Nvidia—arguably the most influential stock in the world right now due to its leading role in the AI boom—continues to tumble, dropping 5.07% today alone. That’s a significant move for a stock with a massive $2.62 trillion market capitalization. As I highlighted in my last update, Nvidia has now broken below an uptrend line dating back to early 2024, signaling a bearish shift.

However, the stock is currently hovering just above a major support zone between $95 and $105, which could lead to a short-term bounce. That said, if—or when—Nvidia closes below this critical support, the sell-off is likely to accelerate, dragging down not just Nvidia but the broader U.S. stock market as well.