A Look at Gold's Big Breakout in Multiple Currencies

Gold’s breakout across major world currencies makes it clear this is a powerful, broad-based move with momentum toward $4,000 and beyond.

One of the trademarks of this newsletter is analyzing gold in multiple world currencies to determine whether it is truly firing on all cylinders, rather than behaving like a 12-cylinder Ferrari running on just six. That’s how my dad used to describe me in grade school whenever I brought home a disappointing report card and clearly wasn’t giving my all.

This approach is especially valuable because it reveals whether gold’s strength is genuine or merely the result of weakness in the U.S. dollar, the world’s reserve currency, as the two are essentially competing currencies that move inversely with each other. I used this technique very effectively last September, when it helped me anticipate and confirm gold’s breakout from its summer doldrums and rally toward $3,000 and beyond.

As I showed a few days ago, the breakout in precious metals from their summer trading range has been confirmed. I believe this sets the stage for a runup in gold to $4,000 and beyond, and silver to $50 and higher. This breakout was driven largely by the return of normal trading volume following Labor Day, as well as a string of weak U.S. jobs reports that sharply increase the likelihood of an economic slowdown or even a recession, along with interest rate cuts in the months ahead.

First came the JOLTS report for July, which showed that job openings declined by 176,000 to 7.181 million, marking a 10-month low. For the first time since the COVID-19 pandemic, there were more unemployed individuals than available positions. Next was the weekly initial jobless claims report, which revealed a higher-than-expected increase of 8,000 claims, bringing the total to 237,000. And finally, the trifecta was completed by Friday’s Nonfarm Payrolls report for August, which showed that only 22,000 jobs were added—far below the forecast of 75,000.

With these three weak reports adding to a string of disappointing employment data in recent months, it is becoming increasingly clear that the U.S. is experiencing a job market slump. As a result, there is now an 87 percent chance of a 25 basis point Fed Funds Rate cut at the September 17th meeting, while the odds of a 50 basis point cut have more than doubled over the past week to 10.5 percent, according to the prediction market Polymarket.

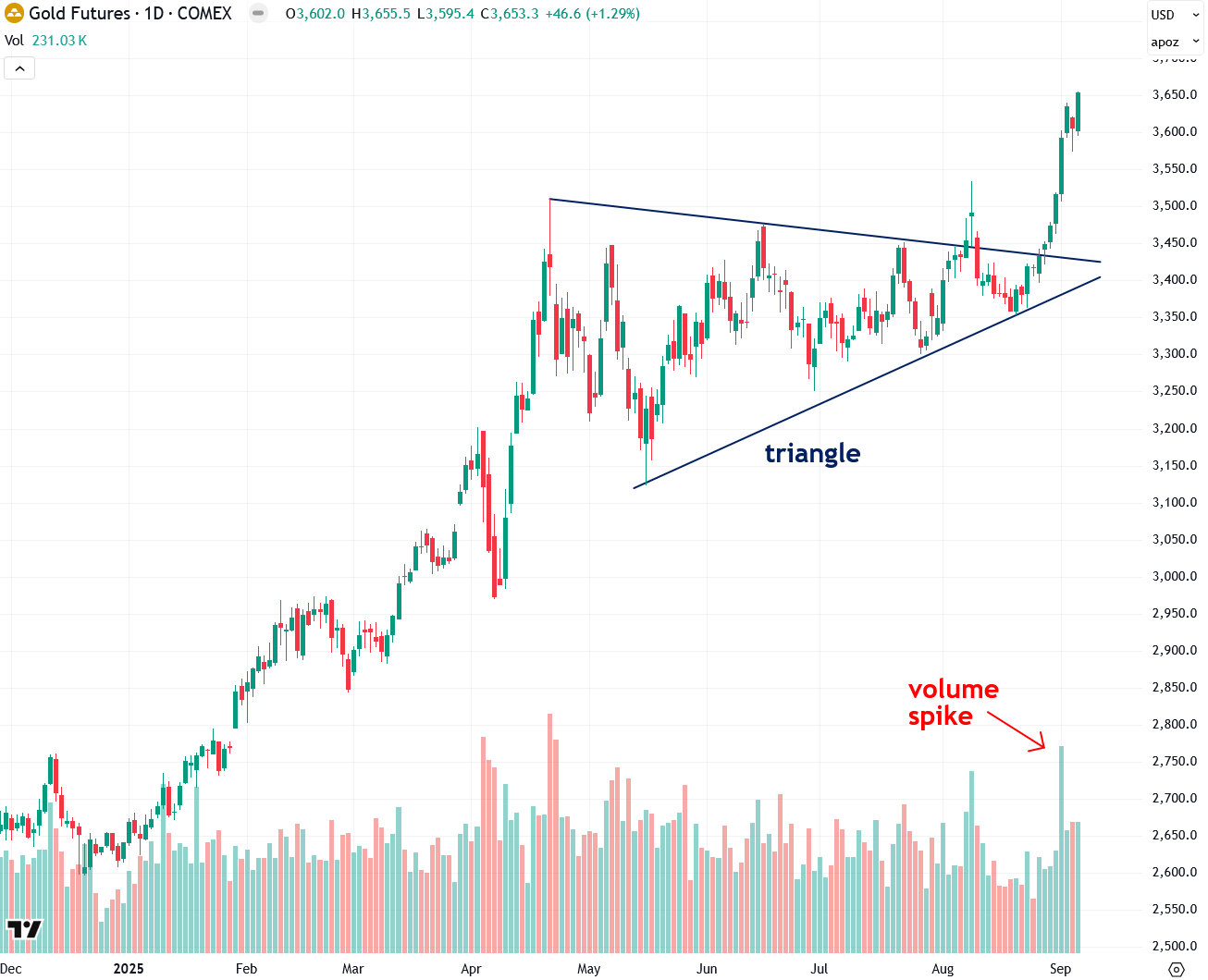

Now let’s take a look at the charts, beginning with COMEX gold futures. Gold has officially broken out of its Summer 2025 triangle pattern, and the breakout was confirmed by a strong surge in volume. This marks a clear liftoff, and everything is now in place for a rally toward $4,000 and likely even higher.

Next, let’s take a look at the spot price of gold in U.S. dollars. Like COMEX gold futures, the spot price has broken out of its Summer 2025 triangle pattern, which is a very encouraging sign.

I had been waiting for both COMEX gold futures and the spot price to break out and send the same message. The two have diverged more than usual lately due to the distorting effects of the Trump administration’s tariff plans and the speculation surrounding them.

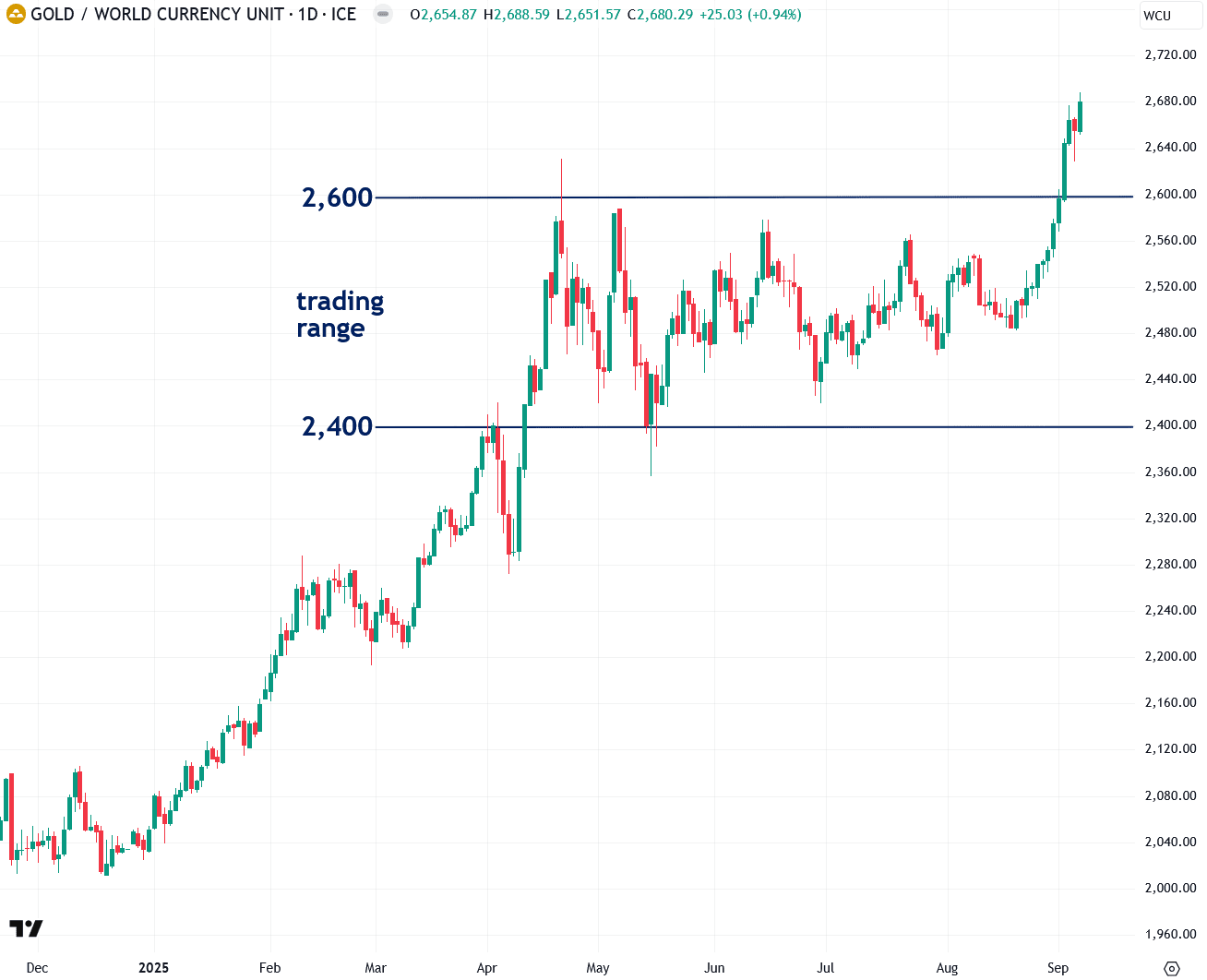

I track gold priced in the World Currency Unit (WCU), which is a composite currency based on the GDP-weighted average of the world’s 20 largest economies. In many ways, it offers one of the most balanced and accurate reflections of gold’s true global performance, which is why I pay close attention to it.

Since its April peak, gold priced in WCU (World Currency Units) had been consolidating within a trading range between 2,400 and 2,600. It finally closed above the 2,600 resistance level last week, which is a major sign of strength and confirmation that the summer consolidation is over and that gold’s bull market is resuming.

I also monitor gold priced in euros, as it removes the effects of U.S. dollar fluctuations and often gives a clearer picture of how gold is performing in its own right. Since February, gold in euros had been trading in a range between €2,700 and €3,000.

Thankfully, gold priced in euros finally closed above the critical €3,000 resistance level last week. This is a very positive development, as it confirms that gold’s bull market is now firing on all cylinders. It shows that gold’s strength is genuine and not simply a result of U.S. dollar weakness.

Gold priced in Swiss francs broke out of its trading range last week, which is particularly significant given that Switzerland is a major hub for the international gold industry.