Investor Euphoria Is Back—And That’s a Red Flag

The speed and intensity of the rebound in investor optimism has outpaced the actual market itself—an unusual and worrisome signal.

A few days ago, I published a market analysis titled 'Is This Market Rebound Just a Dead Cat Bounce?', in which I examined the stock market’s recent recovery from its early April lows. I laid out several reasons for my skepticism, including the fact that the rebound was largely driven by retail traders—considered the 'dumb money'—along with weak trading volume and the broader market’s confirmed downtrend, which favors 'selling the rips' over 'buying the dips.' In this follow-up piece, I’ll highlight additional compelling evidence that reinforces the case for continued caution regarding this latest bounce.

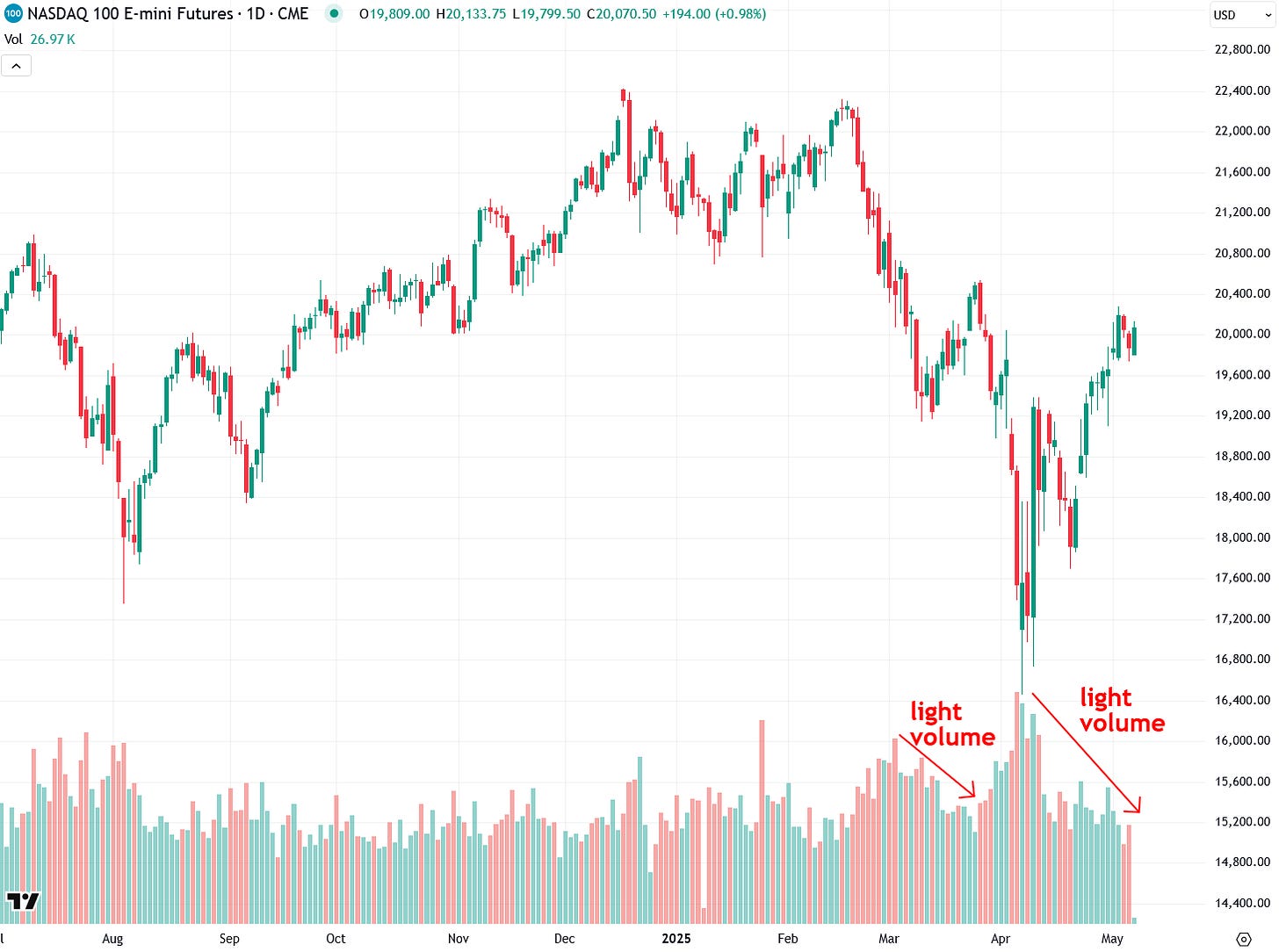

While scanning headlines this morning, one in particular stood out: 'The worst probably isn’t over for the stock market — here’s why,' a MarketWatch piece by columnist Mark Hulbert. Hulbert specializes in tracking market sentiment—especially among stock market newsletter writers—and reporting his findings. Like me, he follows a contrarian approach based on the idea that the majority of market participants are typically wrong, and that extreme sentiment tends to signal key turning points. The article is behind a paywall, but I’ll summarize his key arguments and share an interesting chart he included.

Mark’s case for skepticism about the market rebound centers on the sharp surge in investor optimism, which has outpaced the actual gains in stock prices. In other words, sentiment has gotten well ahead of reality. Many investors are acting as if the worst of the tariff-driven volatility is already behind us. From a contrarian perspective, that’s a troubling sign. As Mark points out, markets typically climb a 'wall of worry'—but the wall that was still standing just weeks ago is now rapidly crumbling amid a resurgence of investor euphoria.

Mark further explained that, typically, investors become more cautious—not less—after a sharp market correction like the one we’ve seen in recent months. Corrections serve as wake-up calls, reminding investors of the inherent risks in the stock market. So even if prices recover, there’s usually a lingering sense of caution due to the gut-wrenching plunge they just endured.

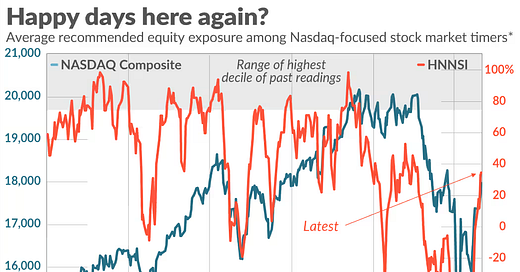

What makes the recent rebound especially unusual is that investors are now more optimistic than they were even before the tariff-related market plunge that began on April 2nd—'Liberation Day.' Mark illustrates this clearly with his Hulbert Stock Newsletter Sentiment Index (HSNSI), shown in the chart below, which tracks the average equity exposure recommended by the financial newsletters his firm monitors. This sharp surge in bullish sentiment, despite the risks that still loom (including a recession), is a clear contrarian red flag.

It’s not just the Hulbert Stock Newsletter Sentiment Index flashing warning signs—other indicators are also showing a worrisome surge in investor optimism. One of the most widely followed is the CNN Fear & Greed Index (see chart below), a composite measure based on several sentiment-related variables, including market momentum, stock price strength and breadth, put/call options, volatility, safe haven demand, and junk bond appetite. As the chart shows, investor optimism has surged far more than stock prices themselves—another clear sign that sentiment is getting ahead of itself.

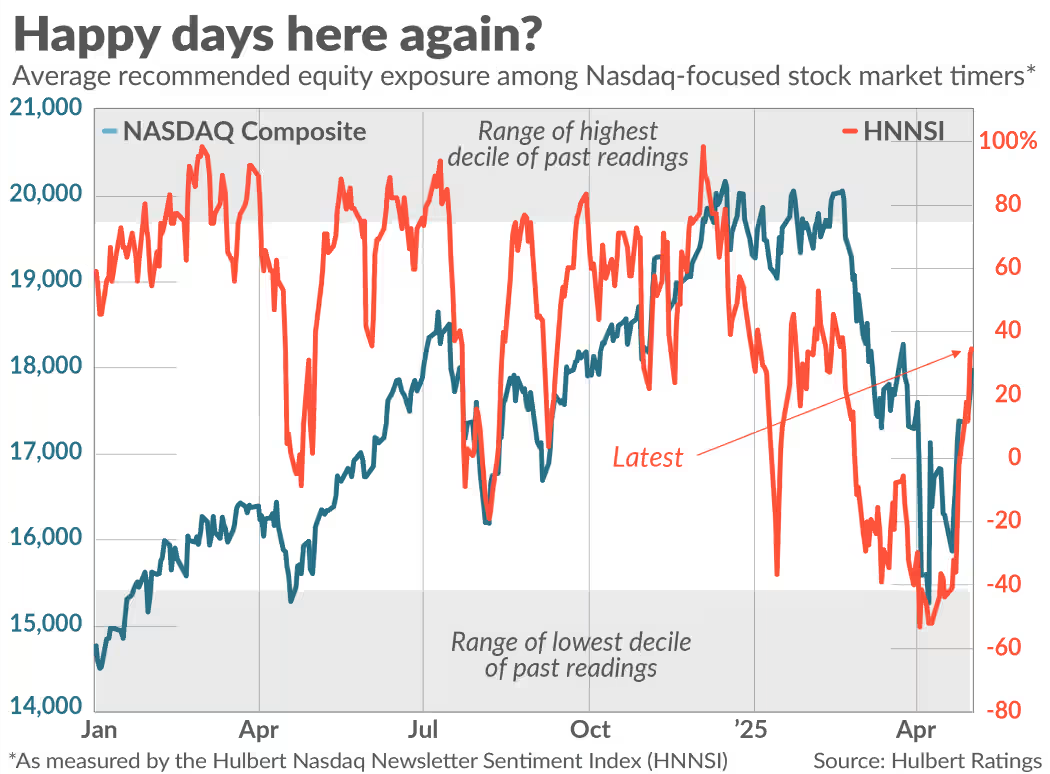

Another important factor is that, in recent weeks, one group has stood out for its overwhelming optimism about the stock market: retail investors. In April alone, they poured a record $40 billion into U.S. stocks—even as institutional investors continued to sell or remain on the sidelines. That’s a major red flag for the sustainability of this rebound.

Retail investors—often referred to as ‘dumb money’—are the least informed and are typically on the wrong side of major market turning points. Meanwhile, institutional investors—the so-called ‘smart money’—aren’t convinced this rally is for real.

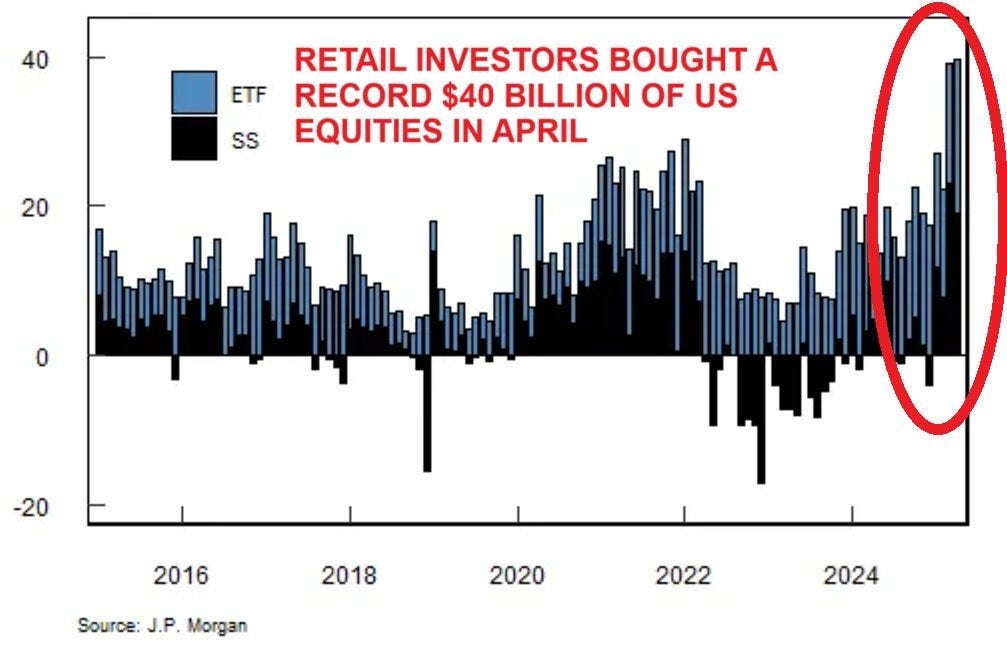

Another reason to doubt the sustainability of the recent market rebound is the exceptionally low trading volume behind it, as shown in the S&P 500 chart below—signaling a lack of conviction or meaningful buying power.

This is a classic hallmark of bear market rallies, or so-called 'dead cat bounces.' It's also worth noting that the mid-March rebound followed a similar pattern: it occurred on weak volume and quickly unraveled, leading to an even steeper decline in early April.

That same lackluster volume is also evident in Nasdaq 100 futures, as well as across other major stock indices and ETFs:

Another important point about the recent stock market rebound is that gold appears to be calling it into question. More specifically, the S&P 500-to-gold ratio—which compares the performance of equities to gold—has barely bounced at all, especially when compared to the S&P 500 itself.

The S&P 500-to-gold ratio’s major technical breakdown from a couple of months ago remains intact, indicating that the trend toward a significant rotation of capital from overvalued stocks into gold is still very much underway, as I detailed in a recent in-depth report.

A telling indication that fear has subsided and speculative enthusiasm is returning is the Volatility Index, or VIX—a widely followed barometer of market fear:

Another widely watched gauge of financial fear—high-yield bond spreads, or credit spreads—measures the difference in yield between high-risk or “junk” bonds and a risk-free benchmark such as Treasuries.

While these spreads have narrowed in recent weeks as sentiment has improved, they haven’t fallen as sharply as the VIX. This may reflect the fact that bond traders are generally more discerning and less emotionally driven than equity investors.

A key development worth noting is the sharp rebound in high-flying, market-leading tech stocks—specifically the so-called 'Magnificent Seven'—from their lows a month ago. This resurgence is a clear sign that animal spirits have returned, as these stocks are favorites among retail investors. The Magnificent Seven includes Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla.

However, it's important to recognize that the recent rebound in the Magnificent Seven stocks—as reflected in the MAGS ETF chart below—may actually represent the formation of a right shoulder in a bearish head-and-shoulders top pattern.

The low trading volume accompanying the bounce is a classic hallmark of right shoulders. To confirm this bearish setup, we’d need to see a decisive close below the $38–$42 support zone. If that breakdown occurs, it will spell serious trouble for both tech stocks and the broader market. I’ll be watching this closely.

Further evidence of resurgent investor euphoria can be seen in the crypto space, as reflected by the recent bounce in the Nasdaq Crypto Index—an index tracking major global cryptocurrencies including Bitcoin, Ethereum, XRP, Solana, Cardano, and others.

Cryptocurrencies are quintessential high-risk, high-volatility assets that tend to move in tandem with speculative tech stocks. The last significant rally in this index occurred following Donald Trump’s victory in the U.S. presidential election last November, ushering in a wave of wild speculation that drove crypto prices sharply higher—until they hit a wall earlier this year.

A notable proxy for crypto investor sentiment—and speculative appetite more broadly—is MicroStrategy (MSTR), a company that essentially functions as a leveraged, debt-funded holding vehicle for Bitcoin. I’ve recently described it as having Ponzi-like qualities due to its highly aggressive capital structure.

When MicroStrategy stock is rallying, it’s often a strong signal that animal spirits among crypto and tech investors are being reignited—and that’s exactly what we saw in November, as well as over the past few weeks.

Perhaps the most absurd proxy for crypto froth and speculative excess is Fartcoin—a meme coin that debuted around the U.S. election and soared an eye-popping 13,000% in less than three months, despite offering virtually no real-world use.

Unsurprisingly, it crashed in January and February, giving back most of its gains. But over the past two months, it has staged a sixfold rebound—signaling that crypto speculators are once again eager to chase vapor. This is not the kind of behavior you typically see during periods of fear or risk aversion.

What’s driving this sharp surge in investor sentiment—beyond the rebound in stock prices?

My theory is that much of it is politically motivated, particularly among the MAGA ('Make America Great Again') crowd. Many in this camp appear to view the recent market turmoil as a politically driven attack on President Trump by Wall Street, the financial media, and the Federal Reserve—believing the market was deliberately tanked to damage his image. To them, buying the dip, cheering on the rally, and participating in it is an act of resistance—a way to push back against what they perceive as an establishment-driven attack on Trump.

I’ve seen numerous examples of this kind of rhetoric in recent weeks, with claims that now is the perfect time to buy stocks ahead of the 'golden age' that Trump is expected to usher in. This narrative has been echoed repeatedly by anchors, contributors, and guests on conservative media outlets like Fox News and Newsmax—including celebrities like Kid Rock, who recently declared he’s ready to 'double down' on his market investments because of Trump.

Unfortunately, I believe the MAGA crowd is completely out of touch with reality when it comes to the idea that everything is great and now is a perfect time to buy stocks because we’re supposedly on the verge of a new golden age. Now, before anyone jumps to conclusions—I’m not on the political left, nor do I suffer from Trump Derangement Syndrome.

I’m a libertarian who believes in free markets, limited government, sound money, and personal freedom. I genuinely want good things to happen, but the reality is that we’re drowning in debt and sitting on numerous extremely dangerous asset bubbles—not just in the U.S., but globally. And frankly, there’s virtually nothing President Trump can do about it, especially since he isn’t meaningfully addressing these systemic issues.

One of the most glaring issues—and a key reason why buying the dip in the market right now is incredibly misguided—is that the U.S. stock market is more overvalued today than it was in 1929, just before the infamous crash and Great Depression.

This isn’t hyperbole—it’s backed by multiple valuation metrics, including the highly reliable cyclically adjusted price-to-earnings (CAPE) ratio, shown below. When valuations reach these extremes, history shows they can only be corrected through a brutal bear market. Yet the talking heads on Fox News are completely oblivious to just how inflated and dangerous this market really is.

Another major reason I can’t buy into the 'Golden Age' narrative is the sheer scale of debt—both in the U.S. and globally. Focusing just on U.S. federal debt, it’s now approaching $37 trillion and growing at an alarming rate of nearly $1 trillion every 100 days.

We're already sitting at just over 100% of GDP, which is widely considered a danger zone for sovereign debt. Making matters worse, the Congressional Budget Office (CBO) projects that U.S. national debt will balloon to around 200% of GDP by 2050—a trajectory that is completely unsustainable (and is a wonderful reason to own gold and silver!).

While Elon Musk’s Department of Government Efficiency (DOGE) has received significant fanfare—and to their credit, they reportedly saved $160 billion, which is commendable—it’s ultimately just a drop in the bucket compared to the $37 trillion in total U.S. debt and the alarming pace at which it's growing. To make matters worse, DOGE is now essentially winding down, with Musk expected to return to his primary role leading Tesla and his other private sector ventures.

To summarize, we've seen a sharp surge in investor optimism in recent weeks—especially among the least experienced participants: retail, or 'mom and pop' investors. Many viewed the recent market correction as a golden opportunity to scoop up stocks on the cheap. The problem is, stocks aren’t cheap—not by any historical measure—and would need to fall significantly further to qualify as true bargains.

Professional investors—the so-called smart money—recognize this, which is why they haven’t rushed back into the market. I know which camp I’m in, and I know who I’d rather bet on. In the meantime, I’m perfectly content sitting in gold, silver, and mining stocks—which, I might add, are showing some real strength.

If you’ve enjoyed this report or have any questions, comments, or thoughts, please give this post a like and share your thoughts in the comments below—I’d love to start a dialogue and hear your perspective.

Disclaimer: the information provided in The Bubble Bubble Report and related content is for informational and educational purposes only and should not be construed as investment, financial, or trading advice. Nothing in this publication constitutes a recommendation, solicitation, or offer to buy or sell any securities, commodities, or financial instruments.

All investments carry risk, and past performance is not indicative of future results. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher disclaim any liability for financial losses or damages incurred as a result of reliance on the information provided.

this is another killer report! it's so nice to hear someone say, "i'm a libertarian".

however, the total u.s. debt is NOT a mere $37 trillion though. it has been well north\

of $200 trillion for years now. you MUST include unfunded liabilities as they are central to

what we actually owe. this puts such things as the Buffett Indicator on the planet

Pluto. in 5,000 years of recorded history world events have never been anywhere

near this insane. the Dark Ages looks like a picnic. today Satan runs the show, and

evil has finally triumphed. it's End Times, but Jesus isn't coming back, and the four

horsemen aren't gonna saddle up. prepare and be ready in every way you can.

Why has not 1 bank failed, in these volatile times

even the bullion shorts must be broke by now...?